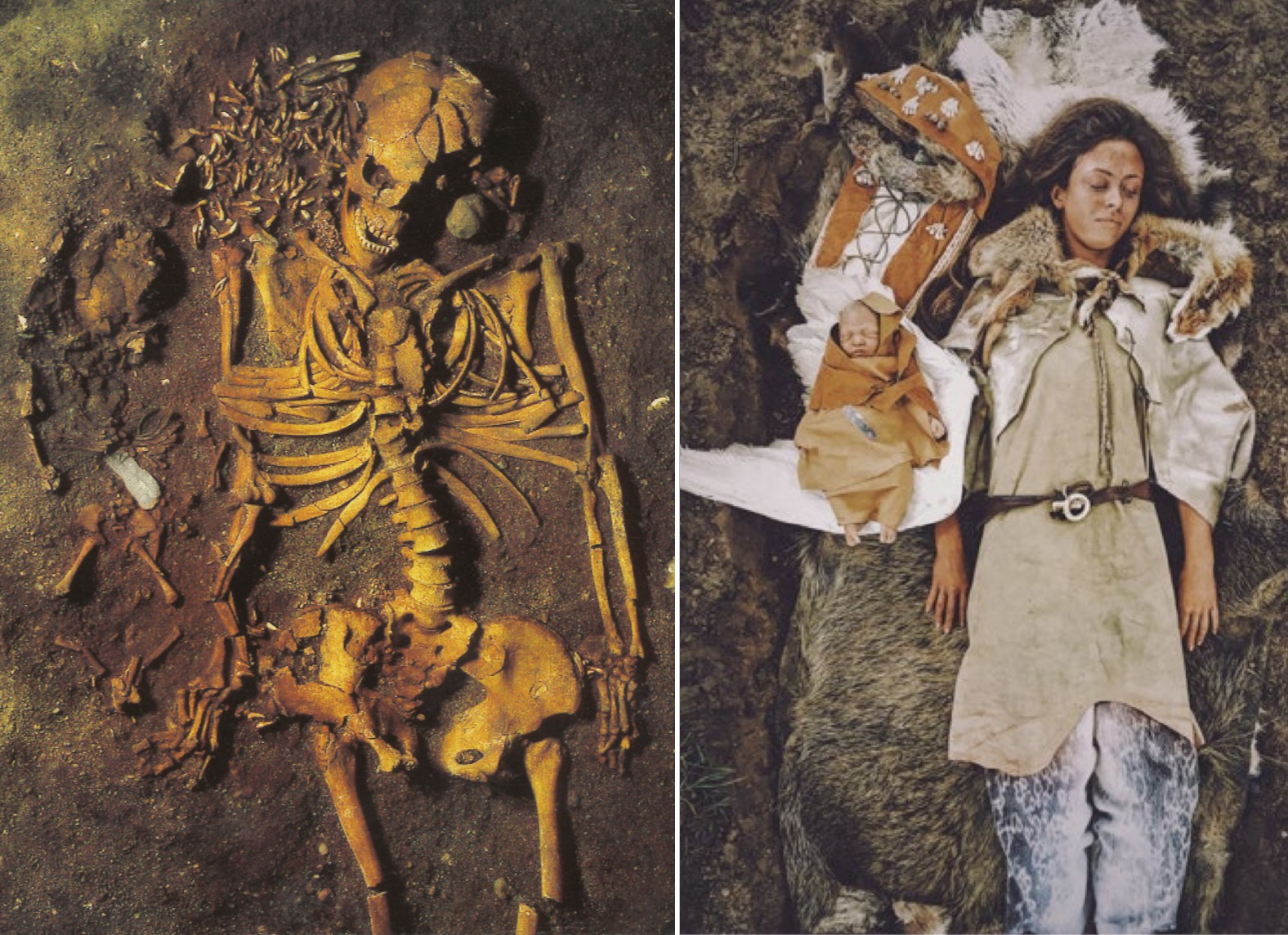

Stone Age Embrace: A 6,000-Year-Old Mother and Child

In a remarkable discovery that bridges the yawning chasm of time, archaeologists in the Netherlands have discovered the oldest baby grave ever found in the region: a touching scene of a 6,000-year-old baby cradled lovingly in the arms of a woman who She is believed to be his mother. Unearthed in a Stone Age cemetery in Nieuwegein, Utrecht, this find offers a deeply human insight into the ancient past, where love and loss were as profound then as they are today.

The tomb, preserved for millennia under layers of earth, tells a story that needs no words. The baby, with its tiny teeth still intact, rests in what appears to be its mother’s protective embrace, a timeless image of connection and pain. For archaeologists, this discovery is not only a scientific milestone, it is a deeply emotional reminder of the universality of the human experience. To think that 6,000 years ago a mother grieved the loss of her child in the same way that families do today is a sobering and powerful revelation.

This burial, dating back to the Stone Age, sheds light on the practices and emotional lives of our ancestors. It is a testament to the family bonds and rituals around death that have existed for thousands of years. The care taken in burying mother and child together suggests an early recognition of the importance of these bonds, even in societies far removed from the complexities of modern life.

The discovery is also a treasure trove of information for archaeologists studying the Neolithic period in this part of Europe. The baby’s well-preserved teeth provide invaluable clues about nutrition, health, and even weaning practices during the Stone Age. These details help build a richer understanding of how these ancient communities lived, cared for their children, and coped with loss.

For those who hear this story, the image of mother and child eternally embracing resonates on a deeply emotional level. It’s not just about archeology or history, it’s about the timelessness of love, pain and humanity. This tomb is more than a site of scientific interest; It is a poignant reminder that, despite the vast stretches of time that separate us, the core of human existence remains remarkably unchanged.

The discovery of this tomb has touched hearts around the world, as it reminds us that the history of humanity is a story of shared emotions and experiences. The mother and child, who rest together for 6,000 years, symbolize the enduring power of love, a force that connects us all, no matter the era.