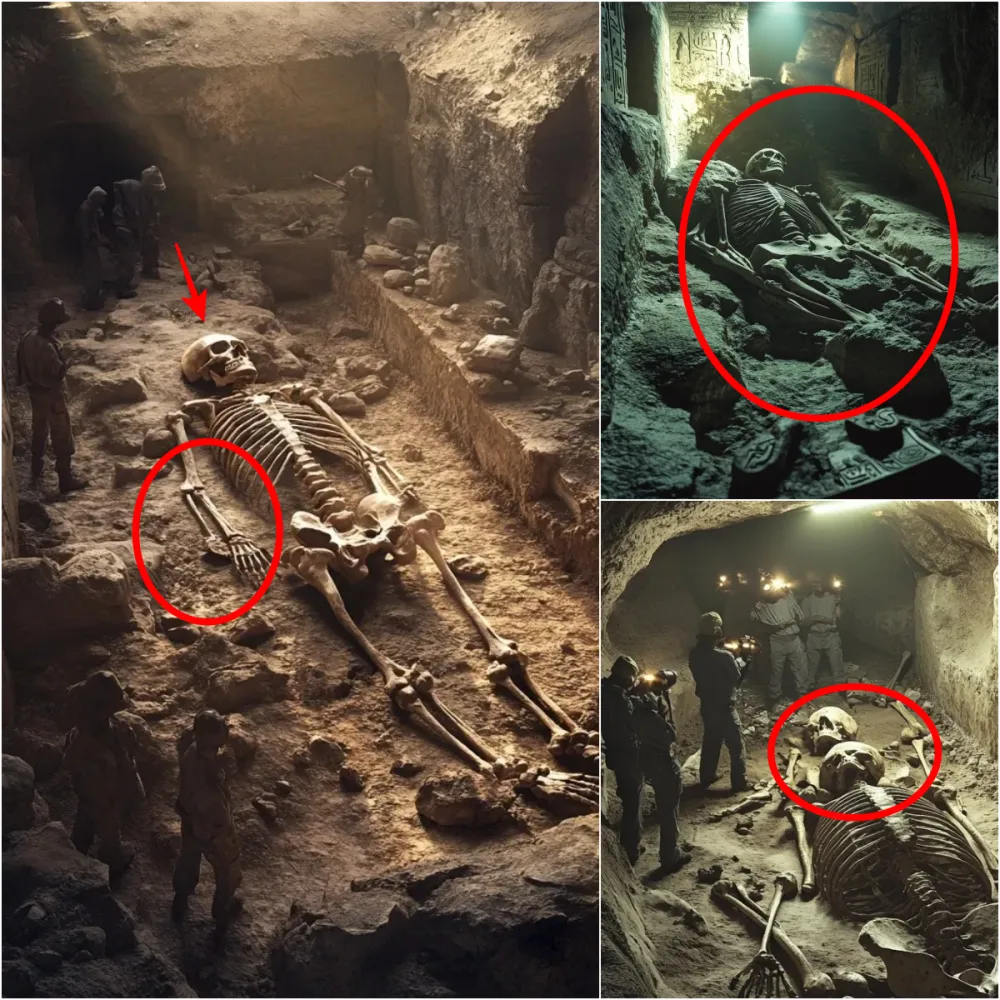

Giant Skeletons Near Egypt: 10,000-Year-Old Remains Unearthed

Last month, an international archaeological team made a groundbreaking discovery near Giza, home to Egypt’s iconic pyramids. Beneath an ancient tomb, researchers unearthed giant human skeletons estimated to be 10,000 years old, revealing a mystery that could rewrite history.

Led by Dr. Helena Carter of Oxford University, the team had been studying the area for over five years. The tomb, dated to approximately 4,500 years ago, belonged to Egypt’s Old Kingdom period. However, beneath the tomb’s foundation, the team uncovered a sealed granite chamber containing several skeletons. Carbon dating revealed these remains were at least 10,000 years old, predating the tomb by thousands of years.

The skeletons measured an average of 3.5 meters (11.5 feet) in height, with skulls and limbs significantly larger than those of modern humans. Remarkably well-preserved due to the desert’s dry conditions, the bones also featured carved markings. Alongside the remains were artifacts inscribed with strange symbols, unlike anything seen in known ancient Egyptian or other world cultures.

The discovery has sparked various theories among researchers, ranging from plausible scientific explanations to more speculative ideas:

- A Forgotten Civilization: The skeletons could belong to a mysterious group of giants that existed long before the rise of ancient Egypt.

- Mythological Connections: Some experts suggest the remains might be tied to legends of giants found in biblical texts or Greek mythology.

- Genetic Mutation or Evolutionary Outliers: Another theory posits these individuals may have been the result of genetic mutations or unique environmental factors that led to their extraordinary size.

Samples of the bones are being analyzed in laboratories worldwide for DNA testing and carbon dating to confirm their origins. Researchers aim to determine if these individuals were an offshoot of modern humans or a completely distinct species. Meanwhile, the mysterious symbols found with the skeletons are being studied by epigraphers to decode their potential meaning.

Additionally, further excavations in the area are planned to uncover more clues about this ancient civilization and its relationship to the giants. The team hopes their findings will shed light on this enigmatic chapter of human history.

While the discovery has generated excitement, Dr. Carter has urged caution. “We might be on the brink of uncovering something revolutionary, but we must base our conclusions on rigorous scientific evidence,” she said.

Could this astonishing find unlock the secrets of a lost era, or will it remain one of the unsolved mysteries of history? The answers, as always, lie in further research and patience. Stay tuned for revelations that may change our understanding of the ancient world forever.

An international archaeological team near Giza has unearthed 10,000-year-old skeletons averaging 3.5 meters tall, hidden beneath a 4,500-year-old tomb. The discovery includes mysterious symbols and artifacts, hinting at a lost civilization or connections to legends of giants. Are these evolutionary anomalies or evidence of an unknown species? With DNA testing and further excavations underway, this groundbreaking find could rewrite ancient history—or deepen its mysteries.