A New Queen Emerges: Exploring Discoveries Within Neith’s Burial Site

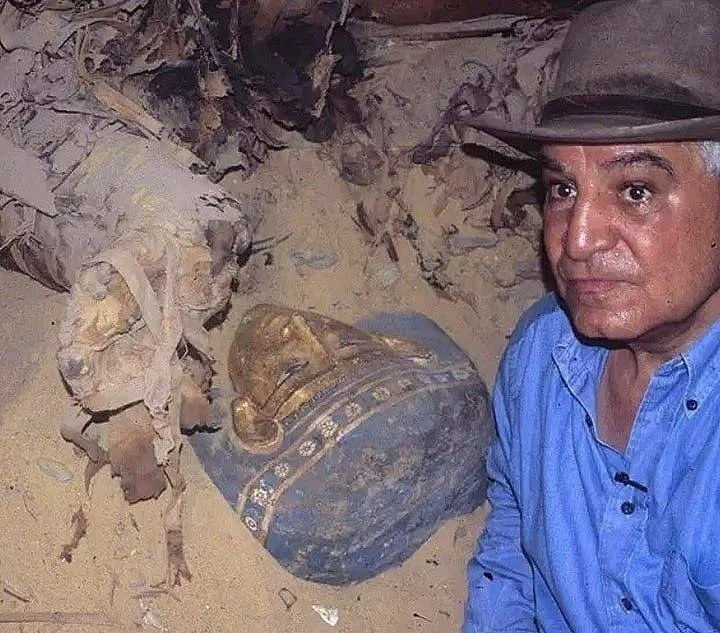

In the sands of Saqqara, Giza, a millennia-old secret has been unveiled, shaking the archaeological world and rewriting the pages of ancient Egyptian history. The tomb of Queen Neith, a previously unknown figure, has been discovered, carrying with it the stories and mysteries of a distant era. Neith, a name no longer obscure, has emerged from the shadows of history, bringing with her astonishment and awe.

The discovery of her tomb, not far from the resting place of the young king Tutankhamun, has raised questions about her role in ancient Egyptian society. The extravagance of her tomb, with its treasure trove of coffins, mummies, exquisite artifacts, and a complex network of interconnected tunnels, suggests she was a figure of significant standing. Archaeologists have identified her as “Neith,” and the titles found in her tomb, such as “Daughter of King Mennefer-Meryre,” “Wife of the King,” and “Mother of the King,” have confirmed this. There is information that she may have been the daughter of Pharaoh Pepi I and the wife of Pepi II, and possibly the mother of Pharaoh Merenre Nemtyemsaf II.

Neith’s tomb, with the largest pyramid among those built for Pepi II’s consorts, contains a red granite sarcophagus and a chest, along with her remains. Pyramid texts, found here for the second time after the inscriptions of Ankhesenpepi II, have provided valuable information about her life and role.

This discovery not only adds a new queen to the list of ancient Egyptian historical figures but also opens up questions about the role and status of queens in that era’s society. The finding of 5,000-year-old wine jars within the tomb also offers further insights into the ancient wine production industry.

These discoveries not only illuminate Queen Neith’s life but also provide a deeper understanding of ancient Egyptian society and culture. The mysteries of the past continue to await discovery, and each new find brings surprises and new understandings of our history.