A Peruvian Warrior from 2000 Years Ago Had a Metal Implant in His Skull

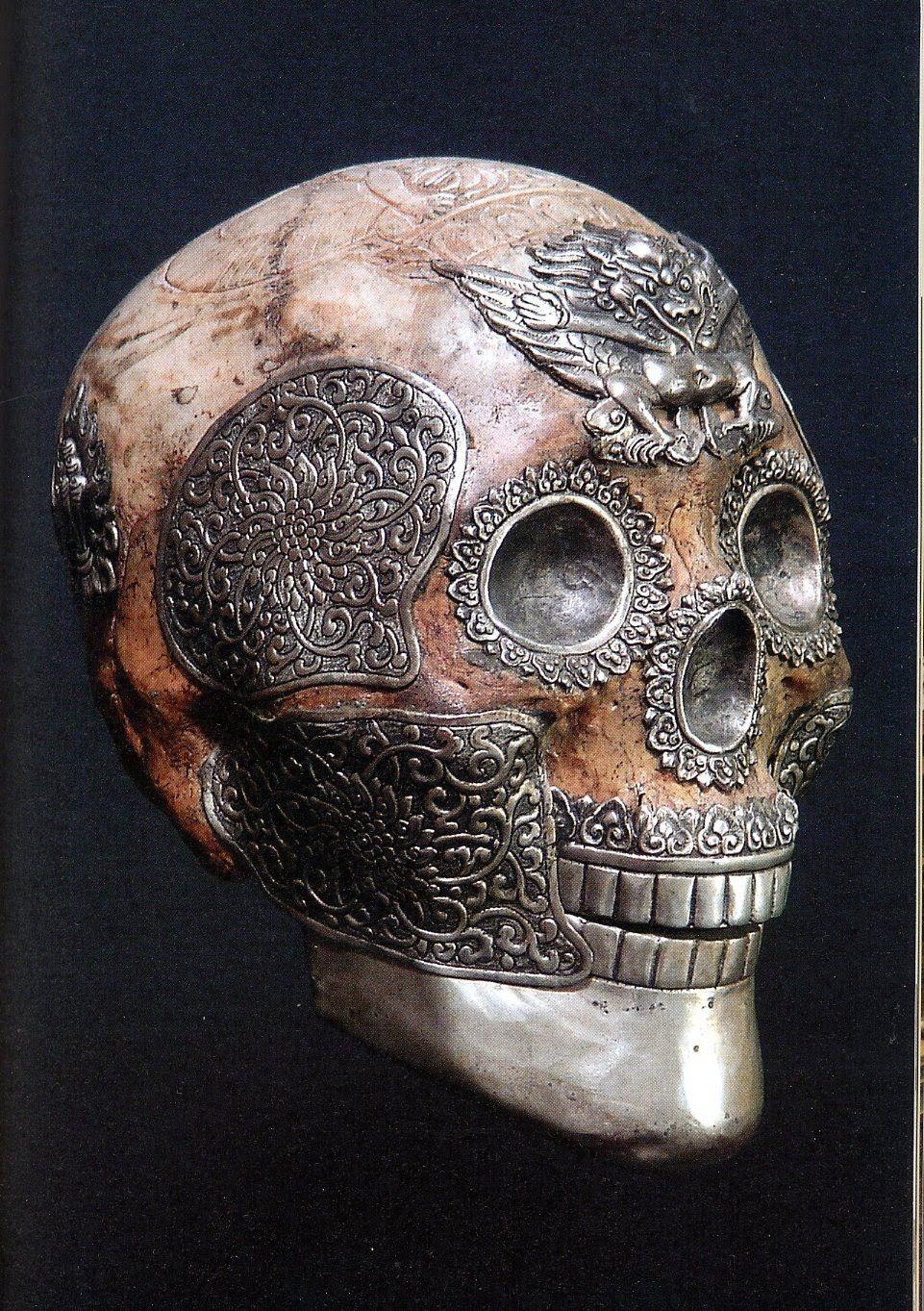

How could an ancient civilization, lacking the advanced medical tools and knowledge we possess today, perform surgery of such precision and complexity? This skull, unearthed on Peruvian land, has baffled experts, calling into question what we thought we knew about the capabilities of our ancestors. The warrior, a man with an elongated skull typical of the cultural practices of his time, suffered a traumatic wound in combat. In response, he underwent a surgical procedure as extraordinary as it is inexplicable to modern science: a metal plate was implanted in his skull.

What is even more astonishing is that not only did he survive this intervention, but the bone around the implant shows signs of complete regeneration. This means that after this advanced surgery, the warrior healed, a detail that challenges any modern conception of ancient medicine. Given this, we are faced with disturbing questions: How did they achieve such a feat 2,000 years ago? Is it possible that these ancient civilizations had medical and technological knowledge that has been lost to history?

We know that cultures such as the Incas, Mayans and Toltecs were masters of metallurgy, working with gold, silver and copper to create jewellery and ornaments, but this find goes far beyond simple ceremonial adornments. What we are seeing is evidence of advanced surgery, something that exceeds our expectations of what these civilisations could achieve. This suggests the existence of forgotten knowledge or, perhaps, the influence of an external and much more developed civilisation than we have imagined until now.

The question is unavoidable: Is this a hint of ancient medical technologies and knowledge that have gone unnoticed by historians? Could this discovery open a door to a completely new understanding of the capabilities of the ancient Peruvians? Or are we looking at evidence of an advanced and unknown civilization that influenced their development? What mysteries still remain hidden in the sands of time, waiting to be discovered?