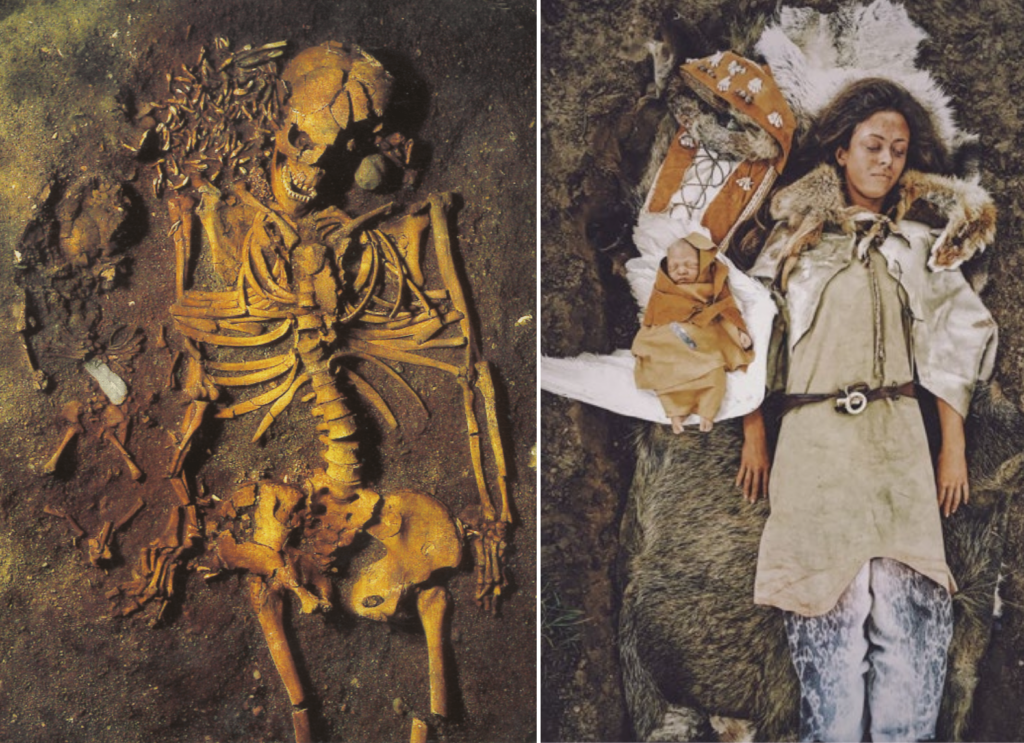

Around 4000 BC, a young woman from Vedbæk, Denmark, was buried with her infant son lying on the wing of a swan.

At the ancient cemetery of Vedbaek, Denmark, an extraordinary discovery from around 4000 BC has captured the attention of archaeologists and historians alike. Known as the “Swan Wing Burial,” Grave 8 contains the remains of a young woman and her child, arranged in a captivating and enigmatic manner.

The young girl is believed to have died during childbirth, leaving behind her premature body. The burial arrangement is what sets it apart as a striking example of ancient symbolism and belief systems. The 𝚋𝚊𝚋𝚢 was carefully placed on the wing of a swan, sparking intense debates among experts about the meaning of this gesture.

Numerous interpretations have been proposed, each attempting to unravel the meaning behind this unique funerary practice. Some speculate that the swan symbolizes purity, while others believe it represents the bird’s ability to traverse water, land, and air, perhaps suggesting passage between realms in the afterlife.

A remarkable aspect of this ancient burial is the care with which the bodies were buried. The young mother’s ribs show signs of having been supported, possibly with an organic “pillow” to ensure comfort and reverence in her eternal sleep. This attention to detail suggests a belief in the continuity of the spirit with the physical body even after death.

The Vedbaek ‘Swan Wing Burial’ remains a captivating mystery, shedding light on the spiritual and cultural beliefs of ancient people who lived thousands of years ago. As archaeologists continue to explore the site and analyse their findings, a window into the past is opening, providing insight into the complex rituals and ideologies of our distant ancestors. The young woman and her child, joined in a delicate embrace with a swan’s wing as a vessel, are a timeless testament to the enduring human quest to understand life, death and the mysteries that lie beyond.