Icebound UFO Base: Giants Below Astonish

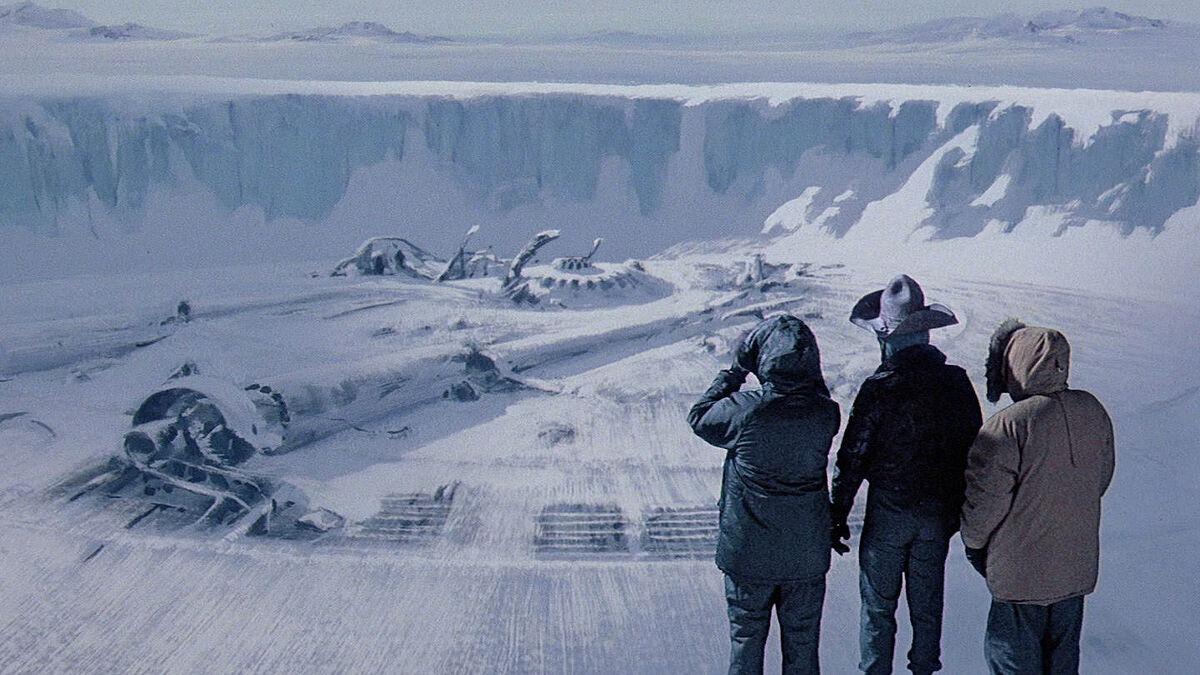

In a startling revelation that has rocked the scientific community, a team of researchers exploring the remote, frozen landscapes of [Locatioп] has uncovered evidence of a truly extraordinary discovery: the remains of a tall A highly advanced alien base, buried deep beneath the ice.

The expedition, led by [Researcher Name], a renowned expert in aerospace engineering and exobiology, was initially sent to study the region’s major geological formations and possible signs of life in the atmosphere. However, what the team ultimately found shattered their preconceptions about the nature of our universe.

“We were conducting a routine ground-penetrating radar scan when the results started indicating the presence of a massive man-made structure buried under hundreds of feet of ice,” [Researcher Name] recalled. “As we investigated further, it became clear that this was a terrestrial formation – it was a highly sophisticated extraterrestrial facility, the likes of which we had never seen before.”

The first findings of the researchers revealed the appearance of a huge disk-shaped object, whose diameter is estimated at more than 150 meters, which was located in the center of the underground complex. Surrounding this colossal UFO were the remains of what appeared to be laboratories, homes and an extensive network of tunnels and corridors.

“The level of engineering and technology in the exhibit is simply astonishing,” [Researcher Name] marveled. “Everything from the building materials to the scale of the installation suggests an intelligence far beyond our own. It’s a chilling reminder that we cannot be alone in this universe.”

Further analysis of the site has revealed a fascinating array of artifacts, including advanced computer systems, exotic alloys and what appear to be fossilized remains of alien life forms. However, the most surprising discovery has been the complete absence of any trace of the facility’s original habitats.

“There are no bodies, no personal effects, no indication of what happened to the beings who built this place,” [Researcher Name] commented. “It’s as if they simply vanished, leaving behind this incredible, abandoned outpost. The implications are fascinating and deeply disturbing.”

As the international scientific community struggles to understand the implications of this groundbreaking discovery, the expedition team is committed to continuing their research, determined to unravel the mysteries that lie buried beneath the ice. “This is a pivotal moment in human history,” [Name of Researcher] said. “The discovery of an extraterrestrial presence on Earth will forever change the way we view our place in the cosmos.”