Cleopatra’s $96 Billion: Secrets of Her Reign

You may have heard of Cleopatra VII, the legendary last pharaoh of Egypt. But did you know that she was also one of the richest people in history? Cleopatra had an estimated net worth of around $96 billion, cementing her place among the richest and most influential figures of all time.

So how did Cleopatra amass such immense wealth? Her financial success can be attributed to several factors. Firstly, she had control over Egypt’s thriving industries, which contributed significantly to her wealth. Furthermore, Cleopatra formed strategic alliances with Roman leaders, which allowed her to expand her economic reach and influence. Finally, her shrewd political and economic decisions played a crucial role in the growth of her fortune.

As we delve deeper into Cleopatra’s incredible life and achievements, we will explore the factors that contributed to her vast wealth and examine her lasting legacy as a powerful ruler and influential historical figure.

Key findings:

Cleopatra VII had an estimated net worth of around $96 billion. Her wealth came from her control over Egypt’s thriving industries and her strategic alliances with Roman leaders. Cleopatra’s financial success solidifies her position as one of the wealthiest and most influential figures in history. Her opulent lifestyle and luxurious possessions reflected her status as a powerful ruler. Cleopatra’s legacy lives on as a symbol of female empowerment and resilience.

Biography of Cleopatra VII

Known as a brilliant strategist, Cleopatra used her charisma and intelligence to maintain and enhance her political power. She established strategic alliances with influential Roman leaders, such as Julius Caesar and Mark Antony , which further strengthened her authority and influence in the ancient world.

Amidst a backdrop of intense political rivalries and power struggles, Cleopatra skillfully deployed her wit and charm to secure support for her reign. Her ability to speak several languages fluently, including Egyptian and Greek , allowed her to communicate effectively with a wide range of people, further cementing her reputation as a skilled diplomat.

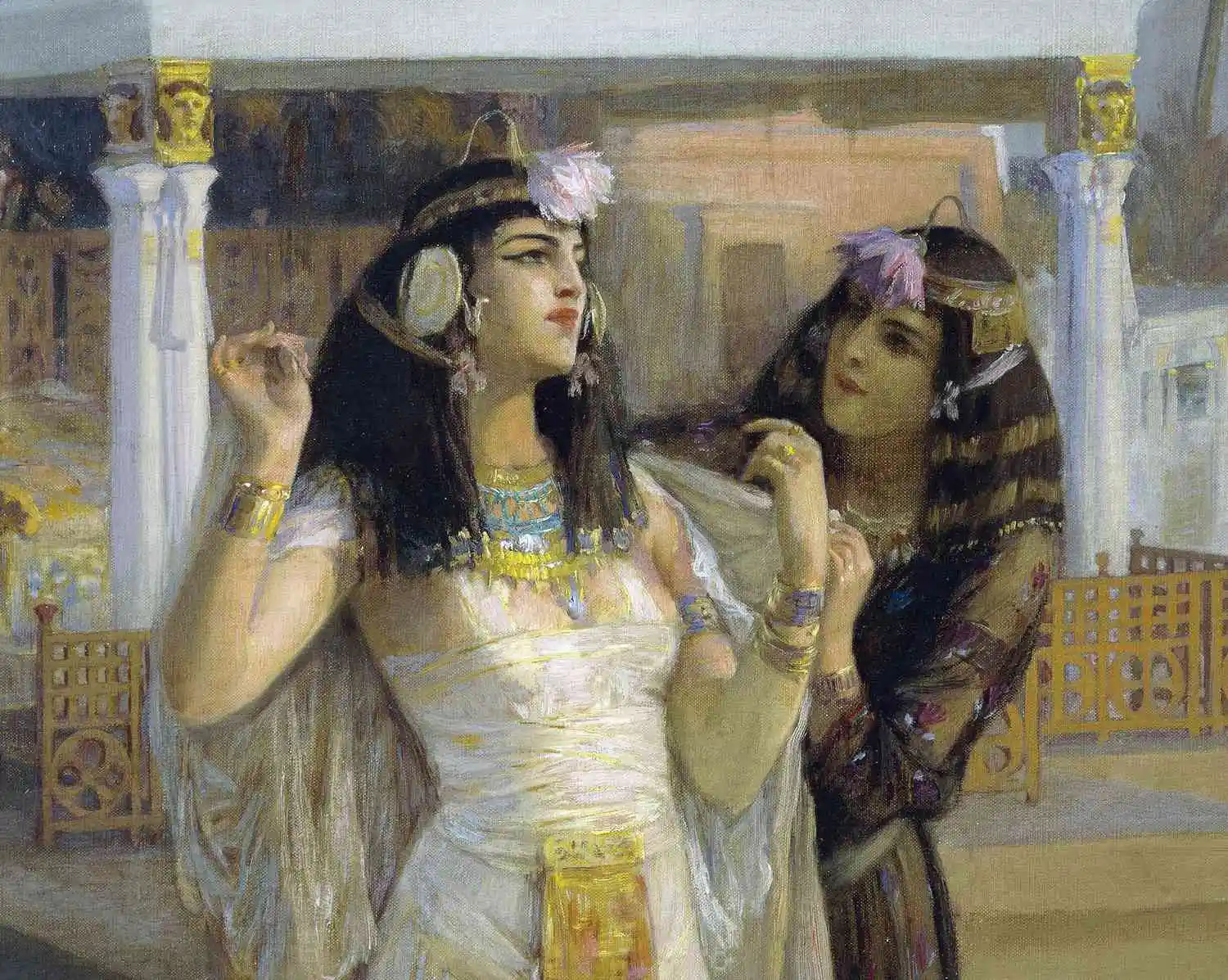

Cleopatra’s achievements extended beyond the political realm, as she amassed a considerable fortune through her control over Egypt’s thriving industries and trade routes. Her opulent lifestyle reflected her wealth and power, with grand palaces, exquisite jewelry, and luxurious clothing befitting her status as ruler of Egypt.

Key achievements:

Political achievementsWealth and economic powerCultural influence

Established political alliances with influential Roman leaders Negotiated peace treaties and diplomatic relations Preserved and expanded Egypt’s territory Controlled Egypt’s lucrative industries and trade routes Accumulated significant wealth estimated at $96 billion Implemented astute economic policies for financial prosperity Promoted and preserved Egyptian culture and traditions Patronage of the arts, literature, and architecture inspired countless artistic performances and cultural interpretations.

Childhood and Royal Lineage

Cleopatra VII was born into the illustrious Ptolemaic dynasty, which rose to power in Egypt after the death of Alexander the Great. As a member of the royal family, Cleopatra had a privileged childhood at the opulent royal court.

From a young age, Cleopatra was immersed in the world of power, politics, and luxury. She received a thorough education and became fluent in several languages, including Egyptian, Greek, and Latin. This early exposure to diverse cultures and languages gave Cleopatra a unique perspective and fostered her intellectual curiosity.

Her royal lineage and upbringing laid the foundation for her future as a strong and formidable leader. Cleopatra’s education and exposure to the intricacies of statecraft equipped her with the knowledge and skills necessary to navigate the complexities of ruling Egypt and maintain her position as pharaoh.

An unforgettable encounter

One of the defining moments of Cleopatra’s childhood was her meeting with Julius Caesar, the Roman general and statesman. At the age of 21, Cleopatra sought refuge in Rome after being expelled from Egypt by her brother, Ptolemy XIII.

This meeting with Julius Caesar marked the beginning of a powerful political alliance and a passionate romance that would shape Cleopatra’s future.

Inherit the power

Cleopatra’s royal lineage and heritage were crucial to her claim as the rightful ruler of Egypt. The Ptolemaic dynasty, which traced its origins to one of Alexander the Great’s generals, established Egypt as its kingdom. Cleopatra inherited the throne from her father, Ptolemy XII, and made history as the first Ptolemaic queen to rule alongside a male co-regent, her brother and husband, Ptolemy XIII.

However, Cleopatra was not content to share power and embarked on a relentless quest to assert her authority as sole ruler of Egypt. Through intrigue, alliances and strategic partnerships, Cleopatra managed to navigate the treacherous world of Egyptian politics and emerged as pharaoh, occupying the throne for over two decades.

Cleopatra VII, known for her intellect and charisma, was also one of history’s wealthiest figures with an estimated $96 billion fortune. She harnessed Egypt’s thriving industries and trade while forming powerful alliances with Rome to secure her place as pharaoh. Fluent in Egyptian, Greek, and Latin, Cleopatra’s diplomacy was unmatched, as was her ability to adapt in a volatile political landscape. Her opulence and strategic brilliance made her a ruler who redefined power and left an enduring legacy as a symbol of resilience and empowerment.