Hunterian Specimen: A Quiet Enigma Persists

In the heart of London, housed within the prestigious walls of the Royal College of Surgeons of England, lies the Hunterian Museum. Rich in medical wonders and curiosities, this museum is a treasure trove for anyone intrigued by the intricacies of the human body. One specimen in particular, hidden amidst the vast collection, has a special story to tell. This is the story of a child’s skull, a silent witness to nature’s fascinating process of change and growth.

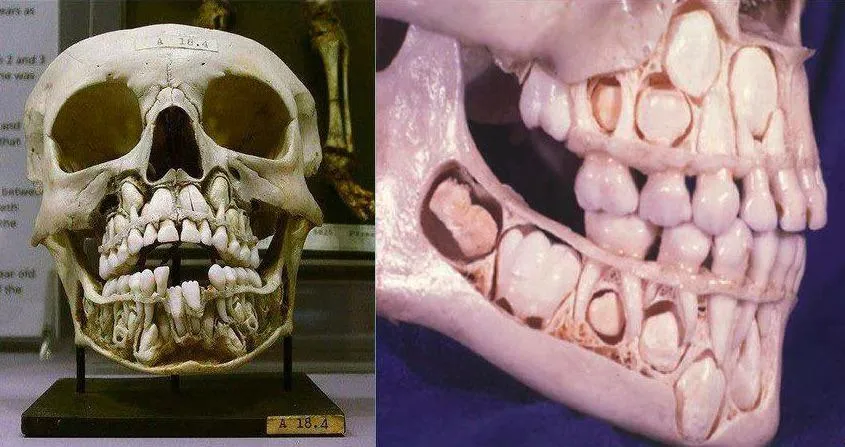

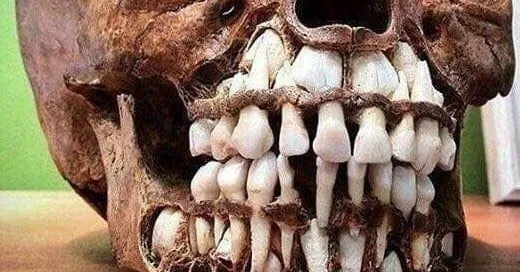

The specimen is a captivating sight, its small frame delicately displaying the wonders of human development. Nestled within, the permanent teeth wait in the wings, poised for their grand entrance. They remain patiently behind the deciduous or baby teeth, which are destined to be dislodged from their place of prominence. It is a stark visual representation of the inevitable, relentless march of growth and time.

Visitors who stumble upon this exhibit are often struck by a sense of wonder and awe. The sight of permanent teeth neatly lined up, tucked away, ready to take their place when the time comes, raises a flood of questions. How does the body know when the perfect time has come for permanent teeth to emerge? What triggers this well-orchestrated biological process?

The Child’s Skull invokes a sense of curiosity and fascination in both adults and children. In children, it is a direct reflection of their journey into adulthood, a journey they are often eager to speed through. For adults, it serves as a poignant reminder of their own transient childhood, a phase of life that once seemed endless but passed in the blink of an eye.

The specimen is not just a static exhibit, but a conversation starter, a thought-provoker, a silent teacher. It tells a story of transition, of the precision of nature’s design and the intricate beauty hidden within us. A fascinating display of nature’s great performance, the Hunterian Museum’s infant skull continues to captivate, educate and inspire visitors from all walks of life.