Early Humans and Tech: Links to a 50,000-Year-Old Realm?

The notion of ancient encounters between early humans and a technologically advanced civilization 50,000 years ago is a fascinating concept that often blurs the lines between scientific research and speculative fiction. While there may be tantalizing evidence and compelling theories suggesting such connections, it is important to approach this topic with a critical eye and an open mind.

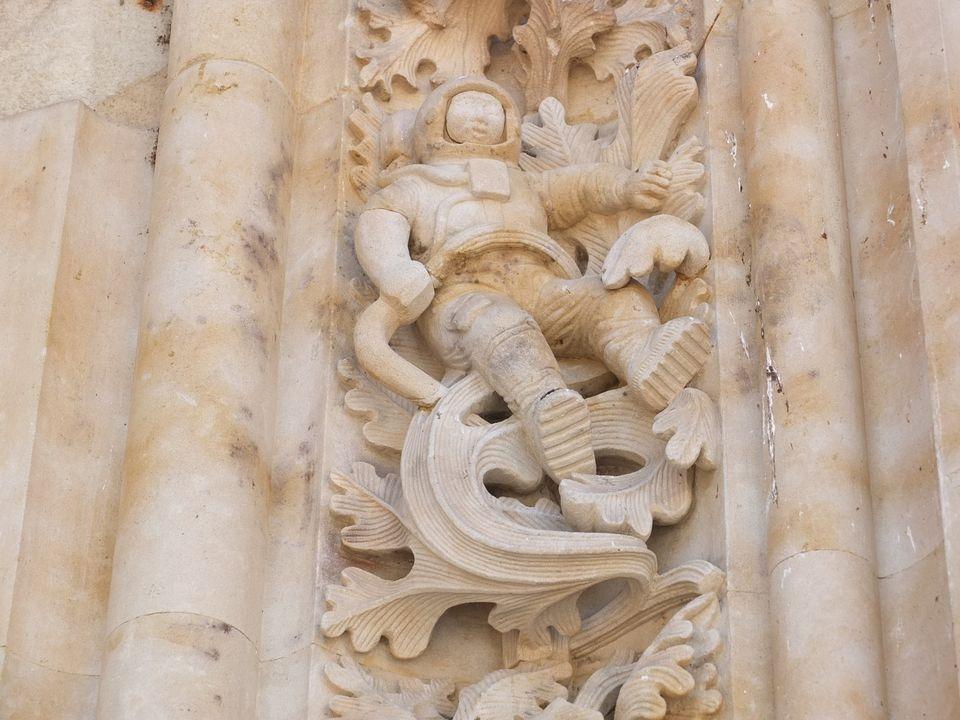

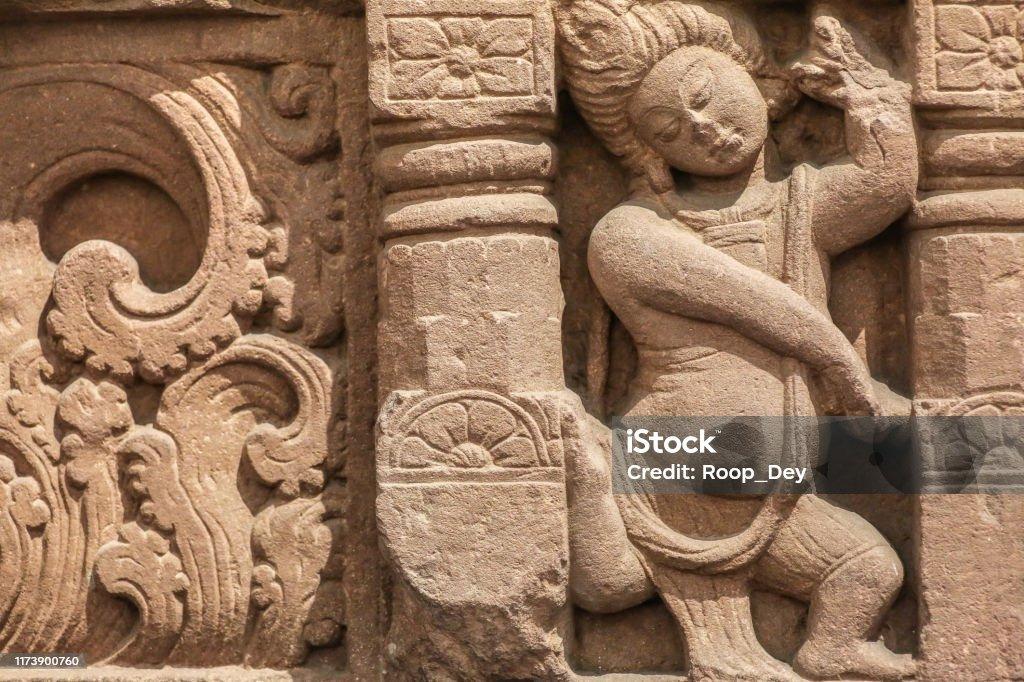

One avenue through which this idea is being explored is through the examination of ancient artifacts and archaeological sites that seemingly defy conventional explanations. From intricate stone carvings to advanced metallurgical techniques, some researchers have proposed that certain artifacts bear the hallmarks of a technology far beyond the capabilities of the societies that produced them.

Furthermore, proponents of the ancient astronaut theory point to ancient texts and mythologies that contain descriptions of otherworldly beings or advanced technologies. These interpretations suggest that early humans may have interacted with beings from beyond Earth, perhaps even receiving knowledge or assistance in the development of civilization.

Furthermore, the discovery of ancient maps and navigational tools that accurately depict geographic features or celestial phenomena has led some to speculate about the existence of a lost civilization with advanced cartographic knowledge. Could these maps be evidence of early human encounters with a technologically sophisticated society?

In the modern era, advances in fields such as genetics and archaeogenetics have provided new insights into the origins and migrations of early humans. DNA analysis of ancient human remains has revealed surprising connections between different populations and distant regions, suggesting complex patterns of interaction and exchange.

Similarly, the study of ancient languages and writing systems has uncovered remarkable parallels and similarities between distant cultures, hinting at possible connections or influences that transcend time and space.

While these lines of evidence may spark curiosity and fuel speculation, it is essential to approach claims of ancient encounters with skepticism and rigor. Extraordinary claims require extraordinary evidence, and investigating ancient mysteries demands a careful balance between scientific inquiry and exploration of the unknown.

Ultimately, the question of whether early humans encountered a technologically advanced civilization 50,000 years ago remains shrouded in mystery and speculation. While the possibility is tantalizing, it is also a reminder of the vastness of human history and the enduring mysteries that continue to captivate our imagination.

Did early humans encounter an advanced civilization 50,000 years ago? Intriguing artifacts, ancient texts, and mysterious maps hint at possibilities beyond conventional understanding. Advanced tools, mythological tales of otherworldly beings, and ancient navigation systems suggest a lost era of knowledge and interaction. With modern DNA and linguistic studies uncovering unexpected connections across civilizations, could this be evidence of a forgotten past? The mystery invites exploration, blending science with the allure of the unknown.