Merrylin Museum’s Wonders: A Biologist’s Dark Collection

In the heart of London, an extraordinary discovery has emerged that has drawn the attention of both the curious and the macabre. Deep in the basement of the historic house, a treasure trove of skeletal remains has been unearthed, revealing a trove of creatures straight out of legend and folklore. This bizarre collection, dubbed the Merryli Cryptid Collection, has sparked a frenzy of speculation and intrigue, challenging the boundaries between the real and the imaginary.

Unearthed history and speculative origins

The origin of this peculiar treasure dates back to Thomas Theodore Merryli, a biologist and wealthy aristocrat of the 19th century. According to legend, in 1960, when the ancient Merryli mansion was scheduled to be demolished, construction workers discovered large sealed boxes in the basement. Upon opening them, the workers discovered a surprising spectacle: the well-preserved remains of creatures that were believed to exist only in the realms of myth and fantasy.

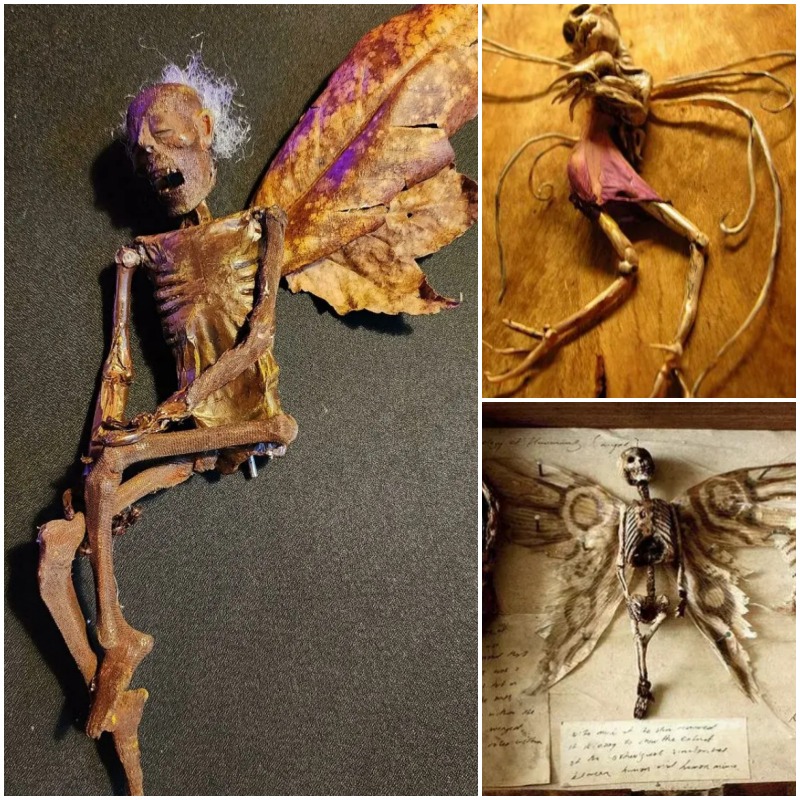

The collection includes a wide variety of specimens, including decomposing fairies with fragile outstretched wings, alien forms and beastly human remains wrapped in skin. Interestingly, the exhibition also includes drawings of Jack the Ripper’s known victims, Catherine Eddowes and Elizabeth Stride, along with jars believed to contain human organs, further amplifying the macabre essence of the collection.

Discovery of the extraordinary

The discovery of these mythical remains has understandably captured the public imagination. The very idea of unearthing creatures long relegated to the realm of folklore and legend has sparked a flurry of speculation and intrigue. It is worth noting, however, that the veracity of these finds and the existence of Thomas Theodore Merryli, as mentioned, are the subject of considerable debate.

Controversy and skepticism

Skepticism prevails due to the lack of scientific proof and verifiable evidence to back up these claims. Many criticise the atheistic nature of the collection, drawing comparisons to film props and suggesting that the geographical discoveries from this landscape should be displayed in prominent venues such as the British Museum.

Artistic revelation

Despite skepticism, the mysterious artifacts were recently put on display by artist Alex CF, who claimed to have access to Merryli’s journals. These writings, according to the artist, supposedly contain discussions on advanced topics such as cosmological physics and multiverse theory, providing scientific basis for the existence of these mythical creatures. Alex CF claims to be the curator of this fascinating collection, which is available for public viewing online.

Public reaction and interpretation

Public response to Merryli’s Cryptid Collection has been a mix of intrigue and skepticism. Some, such as literary commentator James Campbell, have expressed doubts about the atheistic nature of the collection, while others, such as Trey Wait, have expressed admiration for the collection and a desire to own such intriguing pieces, although he acknowledges the possibility that it may be a hoax.

The story of Merryli’s Cryptid Collection weaves a fascinating narrative that captures the imagination of many. Yet it is essential to pay attention to and acknowledge the possibility that this is an elaborate fictional construction. This story serves as a testament to the power of artistic creativity to evoke modes that blur the boundaries between myth and reality, encouraging viewers to appreciate it as a profound work of fiction that challenges other perceptions of the extraordinary.