Exploring and Discovering Ancient Cosmic Visits: Revealing Extraterrestrial Encounters from Earth’s Early History (video)

Within the allures of human history lies a compelling and enigmatic narrative that transcends the boundaries of our terrestrial existence: the possibility of responsive cosmic visitations. Archaeologists and researchers are embarking on a captivating journey to seek out and excavate evidence that may reveal forgotten accomplices with extraterrestrial beings in Earth’s distant past. This mission promises to reshape our understanding of alien civilizations and their potential interactions with entities from beyond the stars.

The exploration begins with a search for cosmic clues embedded in the remains of successful civilizations. Scholars are examining myths, symbols and artifacts that point to the possibility of contact with beings from this world. From apparent cave paintings to hieroglyphics, cosmic perception seems to be etched into the very fabric of human history.

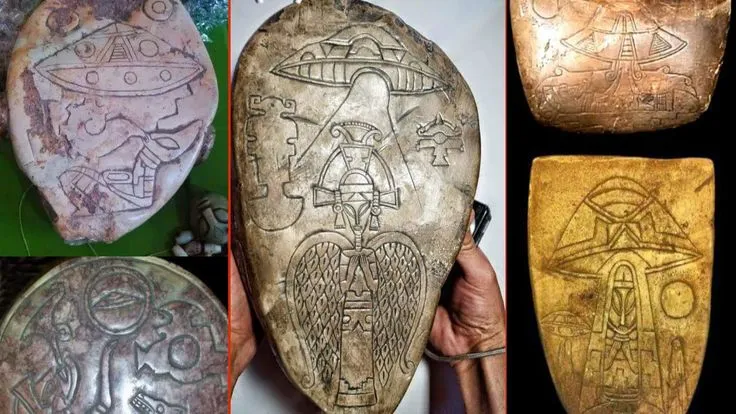

Archaeological excavations are exploring specific sites that promise to uncover extraterrestrial artifacts. Objects with peculiar designs, complex carvings, and anomalous materials are analyzed for signs of advanced knowledge or craftsmanship that could be attributed to influences beyond earthly origins. The goal is to piece together a puzzle that reveals the existence of advanced beings who may have visited or influenced accepted civilizations.

Symbols and iconography play a crucial role in deciphering the cosmic explorers of the past. Researchers are decoding compelling symbols associated with celestial bodies, spacecraft and humanoid figures, searching for commonalities between diverse cultures. The analysis of these symbols aims to reveal a shared cosmic meaning that could bridge the gap between Earth and extraterrestrial entities.

In addition to physical artifacts, researchers are exploring texts and oral traditions that may include hidden accounts of cosmic visitations. Myths and legends from various cultures are being reexamined through the eyes of possible extraterrestrial interactions, opening up new avenues for understanding the true nature of historical events and the beings involved.

The quest to uncover alluring cosmic visitations faces challenges and skepticism. The scientific community emphasizes the importance of rigorous methodology and critical analysis to differentiate between imaginative interpretations and verifiable evidence. Researchers are aware of the need for caution, recognizing that extraordinary claims demand compelling proof.

As the search and excavation for alluring cosmic visitations multiplies, humanity stands on the brink of a paradigm-shifting revelation. The quest to reveal otherworldly ejectors from Earth’s distant past is not simply an exploration of our history, but an invitation to consider our place in the cosmos. Stories recorded in alluring artifacts and texts may hold the key to unlocking the mysteries of our cosmic interactions, offering deep insight into the possibility that our ancestors shared this planet with visitors.