Aztec Pyramid’s Tunnel: Past Secrets Unlocked

Geologists map secret tunnel and chamber beneath Aztec pyramid

“Teotihuacán, translated from the Aztec language as “birthplace of the gods” or “place where the gods were born”, was a very important religious and cultural center during the Aztec empire.

Less than a decade ago, archaeologists discovered a vertical shaft nearly 60 feet beneath the Avenue of the Dead.

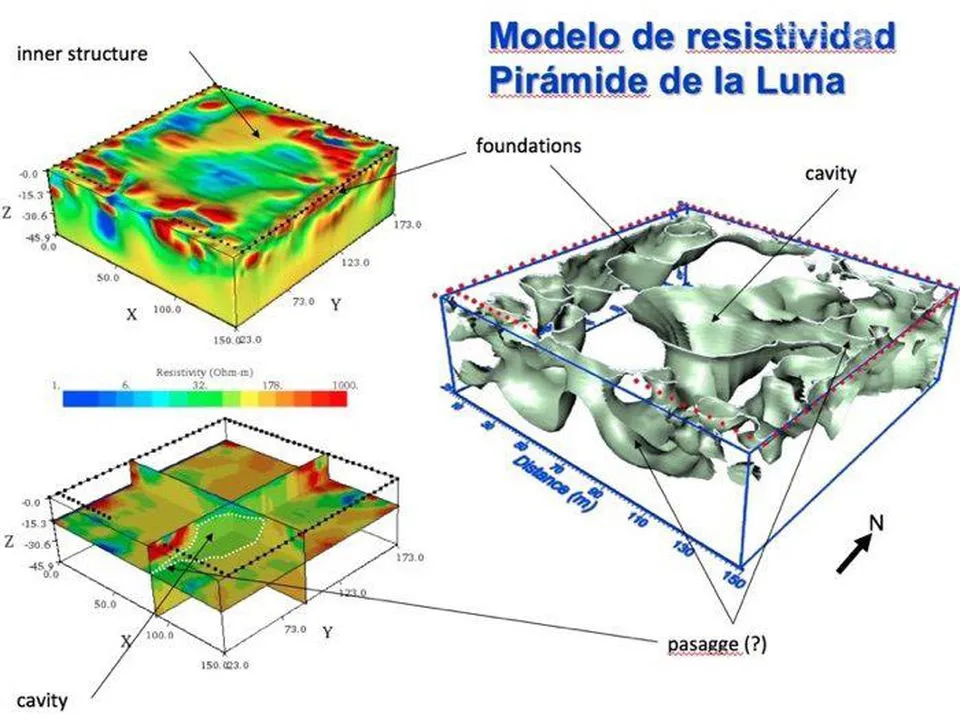

Excavation of tunnels beneath the Avenue was not possible, but in 2017 a team of geologists used electrical resistivity maps to map the subsurface beneath the Avenue of the Dead.

This archaeological site in modern-day Mexico is famous for its wide central “Avenue of the Dead,” surrounded by a dozen pyramids and platforms. The 150-foot-tall Pyramid of the Moon was built in successive phases, with construction completed between A.D. 200 and 250. The nearby Pyramid of the Sun is even taller, at 216 feet.

The excavation revealed a system of tunnels and chambers. Human remains and various objects made from green obsidian, a type of volcanic rock used in religious rituals, were recovered.

The extent of this tunnel system remains uncertain to this day. Archaeologists suspected that the tunnels followed the pattern of streets and pyramids on the surface.

Since it was not possible to excavate the entire site, in 2017 a team of geologists used electrical resistivity imaging to map the subsoil beneath the Avenue of the Dead.

Electrical resistivity imaging is a geophysical technique also used at other archaeological sites to map subsurface composition, revealing large underground cavities or the presence of groundwater.

Researchers discovered a tunnel at a depth of 26 feet, which runs from the center of the avenue to a large cavity 49 feet in diameter hidden beneath the Pyramid of the Moon.

The age and use of this network of tunnels and chambers remains uncertain. The walls of the excavated tunnels were covered with pyrite dust.

Visitors could see grains of this yellow mineral shimmering in the light of torches, an effect resembling the stars in the celestial sphere. It was suggested that the tunnel system acted as a symbolic gateway, connecting heaven to the underworld and played an important role in religious rites.

The origin of the tunnel system and the city is still under study. Centuries later, the Aztecs built some villages on the site of the ancient city, but it is still unclear whether they used the pre-existing tunnel system.

Around 300 AD, the tunnels appear to have been sealed and no one knows why or what the chamber may hide.