History Gets It Wrong: 3 Breakthrough Discoveries from Thousands of Years Ago in Ancient India.

In this article, we take a look at three ancient Indian sages, who knew of advanced discoveries thousands of years before the modern era. It turns out that what we are taught as advanced and modern is, in fact, thousands of years old after all. Interestingly, these three discoveries were left out of our history books.

Yes, it is no surprise that mainstream science loves to brag about how great it is, taking credit for countless technological inventions that today, make our lives easier in a great way. However, because of the numerous missing pieces in our history, and especially because our education system is in such a bad state, we fail to realize that most of these amazing discoveries that we consider as modern, are in fact thousands of years old, dating back to very advanced civilizations in our past history.

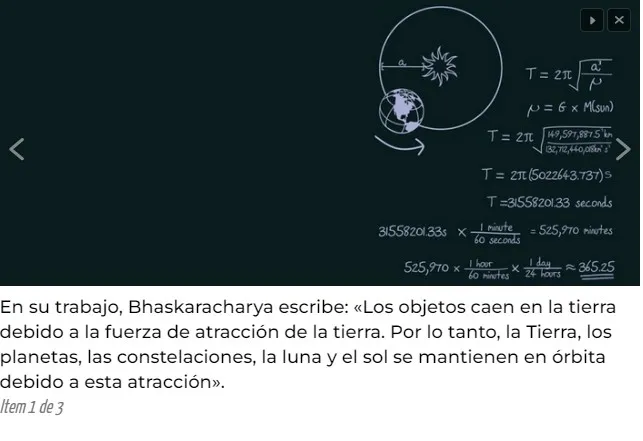

For example, did you know that the law of gravity was proposed hundreds of years before Newton discovered it? Yet, history books tell us that it was Newton who “determined” gravity. The truth, however, is quite different. Bhaskaracharya II was a mathematician and astronomer from ancient India, and his works represent a significant contribution to mathematical and astronomical knowledge in the 12th century.

Even today, Bhaskaracharya’s works ‘Lilaviti’ and ‘Bijaganita’ are considered unique and unprecedented in science. In his writings, the ancient Indian genius mainly commented on the spread of planetary eclipses and cosmography. However, his most important work is his revolutionary theory of gravity, which predates the theory of gravity proposed by Isaac Newton 500 years ago.

Why is this not being taught in school?

Mainstream scholars suggest that the Wright brothers invented the modern concept of the airplane. However, there are numerous indications to the contrary, suggesting that aviation was developed around the time of the Ramayana and Mahabharata. Maharishi Bhardwaj describes incredible flying machines that could “disappear” and travel to other planets. The Vaimanika Prakarana, written by the sage Maharshi Bhardwaj, is about aeronautics, has eight chapters, a hundred topics, and 500 sutras.

In it, Bhardwaj describes the vimanas, or aerial vessels, as having three classes: those that travel from one place to another; those that travel from one country to another; and those that travel between the planets.

As strange as this part of the story may sound, it has also been left out of the modern history books, but why?

Atomic theory was developed 2,600 years ago in ancient India.

Yes, history books suggest that John Dalton, an English chemist and physicist, was credited with developing the theory of the atom. However, the truth is quite different.

It turns out that about 2,500 years before Dalton, an ancient Hindu sage and philosopher named Kashyap developed the atomic theory. People called him “Kanad, like Kan,” which in ancient Sanskrit means “the smallest particle” after he was seen collecting grains from the street, during a pilgrimage to Prayag. He was fascinated by the small particles and began collecting them. It was Kanad who also proposed the idea that anu (atoms) could combine in various different ways that would produce chemical changes in the presence of other factors like heat. To provide a more simplified explanation, Kanad gave the blackening of the earthen pot and the ripening of the fruit as an example.

This discovery is also missing from our history books. Do you need more proof that history books are wrong? Why are we taught so incorrectly in school?