History of public latrines in ancient Rome

When archaeologists explored public toilets in ancient Rome , they found that they resembled a modern smoking room. People in need not only went to the toilet to do their business, but also as a place to discuss recent news. The toilet is designed as a long stone bench with many holes at the top and in the front facade. There are no divisions between the places as in modern times, but in order to communicate with each other, here the Romans could freely talk about life right in the toilet. The ancient Romans used sponges tied to the end of a stick and after using them they would dip the sponge into a bucket full of water so that the next person could… reuse it. With this way of defecating, a Roman toilet was not considered a boring, even very bustling place. The walls surrounding the toilet area are also decorated with beautiful statues. However, to go to the toilet in places like this, people have to pay a fee, so poor people almost never go to these toilets. Some toilets even have a special heating system. In the 4th century, during the reign of Diocletian, there were 144 public toilets in Rome. However, the accumulation of large amounts of methane gas makes the toilets dangerous, as they often explode. When going to the toilet, Romans often pray under the statue of Fortuna in the hope that a miracle will help them survive entering the toilet. You may not believe it, but this sensitive topic has caused many scientists to put a lot of effort into research.

When archaeologists explored the public baths of ancient Rome , they noticed that they resembled a modern smoking room.

People in need are not only present in the bathroom to relieve their “sadness”, but also a place to discuss recent news.

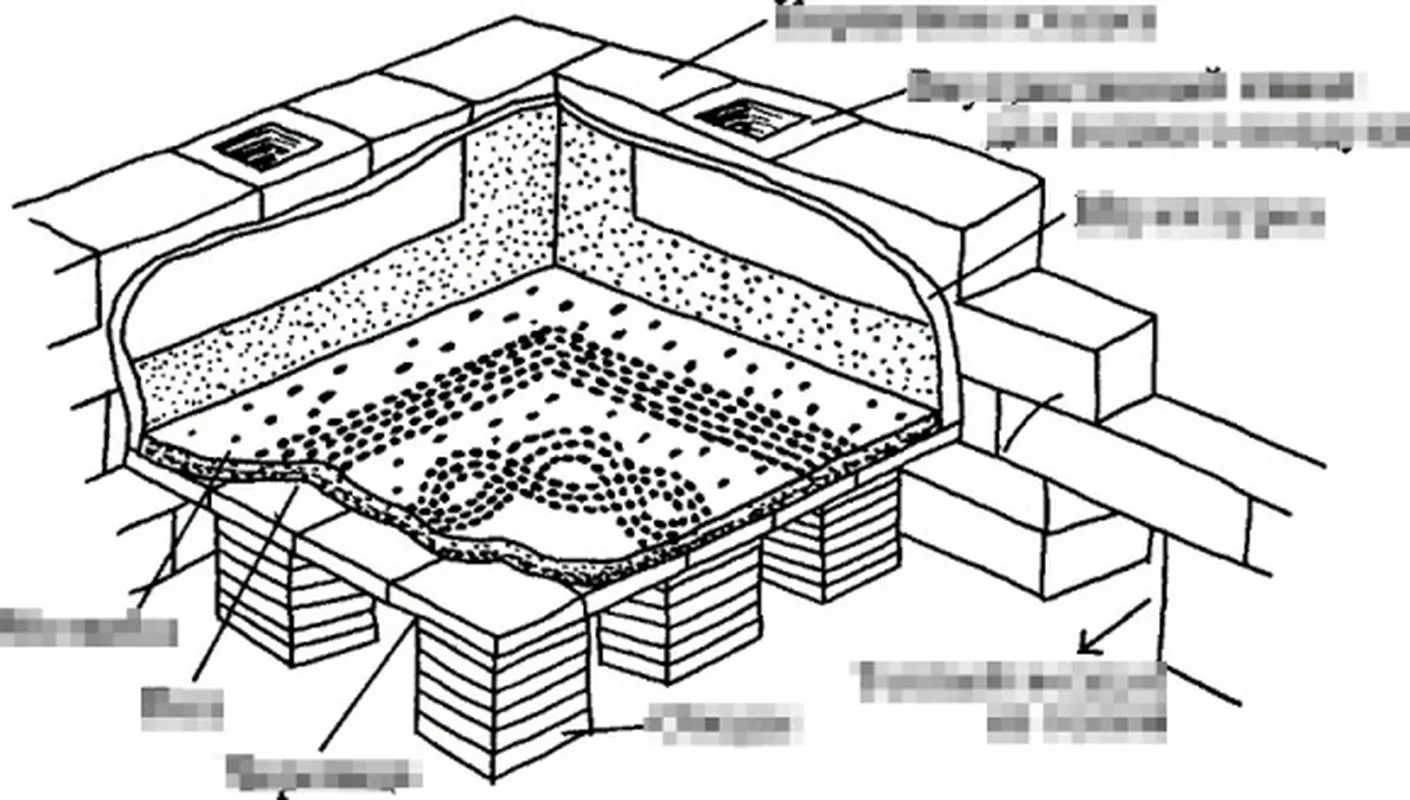

The bath is designed as a long stone bench with many holes at the top and on the front facade. There are no divisions between the places as in modern times, but for communication with each other, so here the Romans could freely talk about life right in the bath.

The ancient Romans used a sponge tied to the end of a stick and after using it, they would dip the sponge into a bucket full of water so the next person could… reuse it.

With this way of going to the bathroom, a Roman bath was no longer considered a boring place, but was even very bustling.

The walls surrounding the bathing area are also decorated with beautiful statues.

However, to go to the toilet in places like this, people have to pay a fee, so poor people almost never go to these toilets. Some toilets even have a special heating system.

In the 4th century, during the reign of Diocletian, there were 144 public baths in Rome.

However, the build-up of large amounts of methane gas makes toilets dangerous as they often explode, so before going to the toilet, Romans used to go and pray under the statue of Fortuna in the hope that a miracle would help them survive entering the toilet.

You may not believe it, but this delicate subject has caused many scientists to devote a lot of effort to research.