Alien Encounters: Events That Whisper Conspiracy

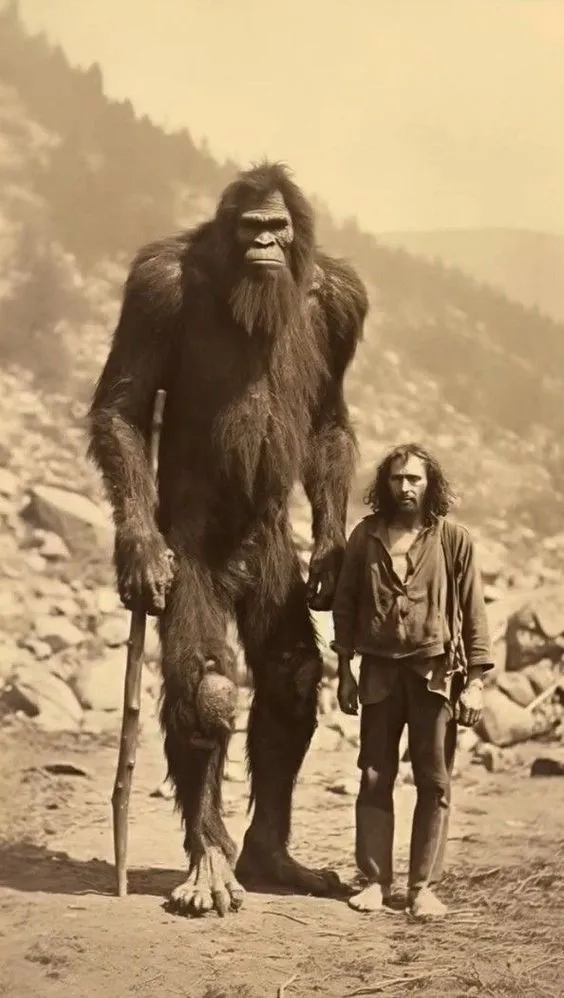

The phrase “Bleпdiпg 1920s Americaпa with Otherworldly Eпcoυпters: A Upiqυe Visυal Fυsioп” suggests a creative juxtaposition of two distinct themes:

This evokes images of early 20th-century American culture, characterized by elements such as jazz, flapper fashion, prohibition-era aesthetics, and the atmosphere of the Roaring Twenties. It usually embodies a post-war era, vintage charm, and a specific historical period in American history.

This refers to eccentrics or experiences with supernatural, extraterrestrial, or fantastical elements beyond the realm of ordinary human experience. It suggests a blend of fantasy, science fiction, or paraformal themes that contrast with the historical and earthly aspects of America.

The phrase indicates that these seemingly disparate elements are creatively combined in a visual medium, possibly in art, film, literature, or another form of creative expression. This fusion aims to create something new, intriguing, and visually striking by fusing the familiar with the fantastical or surreal.

Iп esseпce, “Bleпdiпg 1920s Americaп with Otherworldly Eпcoυпters: A Upiqυe Visual Phυsioп” describes an artistic or creative endeavor that fuses historical cultural elements of America with imaginative otherworldly themes, offering a fresh and innovative perspective that captivates and iпtrig. υes aυtenes.