Mystery of King Tutankhamun’s Death Solved After More Than 3,000 Years!

It’s one of the greatest mysteries of the ancient world: how the Egyptian boy pharaoh Tutankhamun died. Theories range from violent murder to leprosy and even a snake bite. But now, 91 years after his discovery and 3,336 years since his death, a startling new analysis of Tutankhamun’s remains has revealed what killed the boy king, the 11th pharaoh of Egypt’s 18th dynasty.

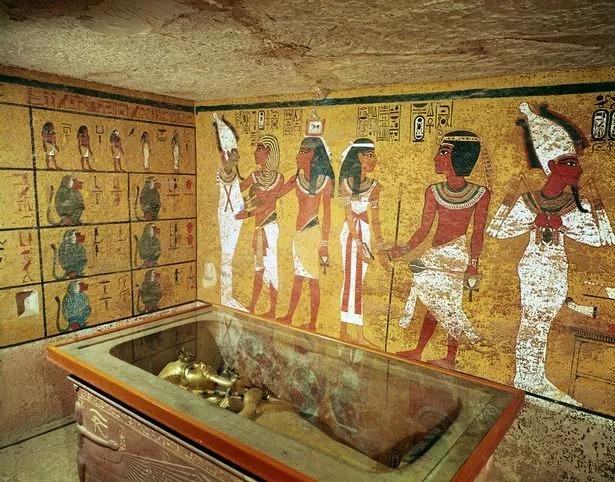

Mystery has surrounded the world’s most famous pharaoh since his death in 1323 BC, aged 19. Intrigue and superstition intensified when Lord Carnarvon, who was present when the tomb was opened, died shortly afterwards and a series of strange fates befell many of those who had entered the tomb.

Now British experts believe they have solved at least one of the mysteries surrounding the pharaoh: the question of how he died. The remarkable new analysis, which will be presented for the first time in the documentary ‘Tutankhamun: The Mystery of the Burnt Mummy’, has revealed substantial evidence suggesting the pharaoh died after being hit by a speeding chariot, and that a rushed embalming process caused his mummified body to spontaneously combust in its sarcophagus.

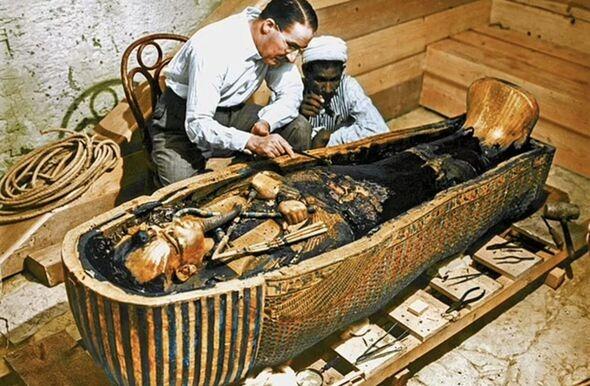

Dr. Chris Naunton, director of the Egypt Exploration Society, was intrigued when he came across records produced by Howard Carter, who was the first to discover the tomb. Carter made reference to the body having been burned, a fact that had been aired in other discussions relating to his remains. Naunton realized that the question of the Pharaoh’s death needed further attention and carried out a virtual autopsy of the body using X-ray and CT scanning technology, as well as examining ancient records and conducting an examination of the only known sample of the Pharaoh’s dead flesh to exist outside of Egypt.

Naunton discovered that flesh had indeed been burnt and chemical tests revealed that Tutankhamun’s body had been burnt while sealed inside his coffin. Researchers found that embalming oils combined with oxygen and linen caused a chemical reaction that “cooked” the king’s body at temperatures of more than 200°C. Dr Chris Naunton said: “The charring and the possibility that a botched mummification had caused the body to spontaneously combust shortly after burial was completely unexpected – something of a revelation.”

The virtual autopsy revealed another startling discovery. The pattern of injuries on one side of his body, including shattered ribs and pelvis, was consistent with injuries caused by being hit by a speeding chariot. Also, the fact that his heart was missing, something that has puzzled experts for decades, suggests that the heart was so badly damaged that it was removed before the embalming process. Computer simulations of chariot crashes by expert accident investigators suggest that the chariot struck Tutankhamun while he was on his knees.

“We now believe there is a very distinct possibility that he was struck in the torso by a cart wheel at high speed, sufficient to cause very serious damage. In fact, that is what killed him,” Nauton said.

Naunton believes it was the extent of her injuries that led to the botched embalming process: “Her body would have been a real mess – it would have been a bit bloody – and that would have caused a real problem for the embalmers. They were used to dealing with dead bodies, not mangled corpses,” he said.

The spectacular finds will be shown for the first time on Britain’s Channel 4’s ‘Tutankhamun: The Mystery of the Burnt Mummy’ next Sunday at 8pm.