Area 51’s Traces: Evidence of the Unseen?

A dusty unmarked road leads to the front gate of Area 51 in the center of the desolate Nevada desert. It is only surrounded by a chain-link fence, a boom gate, and ominous trespassing signs. One would assume that America’s much-mythologized top-secret military base would be better guarded but make no mistake: it is. They are keeping an eye on you. Any angle is visible from beyond the fence, which is guarded by cameras. A white pickup truck with a tinted windshield sits atop a distant hilltop, peering down on everything below. According to locals, the base is aware of every desert tortoise and jackrabbit that crosses the barrier. Others say the approaching road contains embedded sensors.

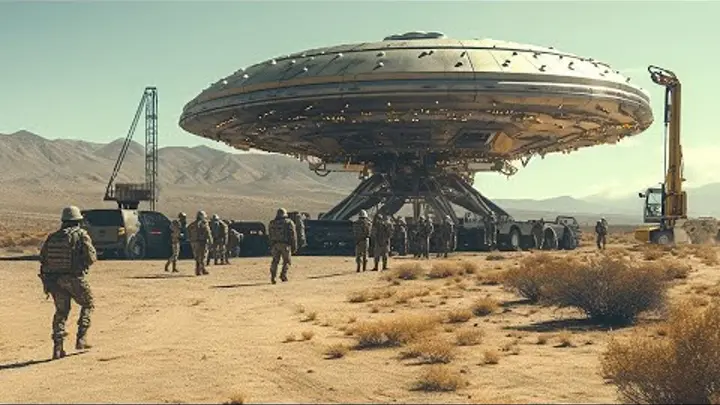

Decades of wild speculation have surrounded what actually happens within Area 51. There are alien conspiracies that say extraterrestrial aliens are hidden inside. One of the more outlandish theories claims that the notorious 1947 Roswell crash was caused by a Soviet plane piloted by mutant midgets, and that the debris is still on Area 51’s grounds. Some also claim that one of the base’s hangars was used to film the 1969 moon landing. Despite all the myths and legends, Area 51 is real and still highly active. There may not be aliens, or a moon landing movie set within those fences, but something is happening, and only a select few are aware of what is going on. Area 51’s forbidden nature is what draws people in to see what is there! That is probably human nature!

The Belgian UFO wave started in November 1989. Most reports were filed some weeks after the incident. Many reports described a huge object traveling at low altitude. Some reports also said the craft had a flat, triangular appearance with lights underneath. The Belgian UFO wave peaked on the night of March 31st, 1990. On that night, one unknown object was detected on radar, and two Belgian Air Force F-16s were dispatched to investigate, although neither pilot reported seeing anything, and no reports were received from the public. However, during the next two weeks, reports from 143 people who claimed to have seen something were received, all of which came after the occurrence. In the months that followed, several others claimed to have witnessed the same happenings.

Marc Hallet produced an essay about the Belgian UFO wave in 1992, some three years after the first incident on 29 November 1989 in Eupen, criticizing the activity of a Belgian UFO organization. According to Hallet’s opinion, the Belgian UFO wave was mostly a mass hallucination fueled by the organization’s efforts. This mass hallucination would have adhered to Philip J. Klass’ law: When news coverage convinces the public to assume that UFOs are nearby, there are various natural and man-made objects that, particularly at night, can take on odd qualities in the eyes of hopeful viewers. Their UFO reports, in turn, add to the widespread enthusiasm, encouraging even more people to look for UFOs. This situation feeds upon itself until such time, when the media loses interest in the subject, and the flap quickly runs out of steam.