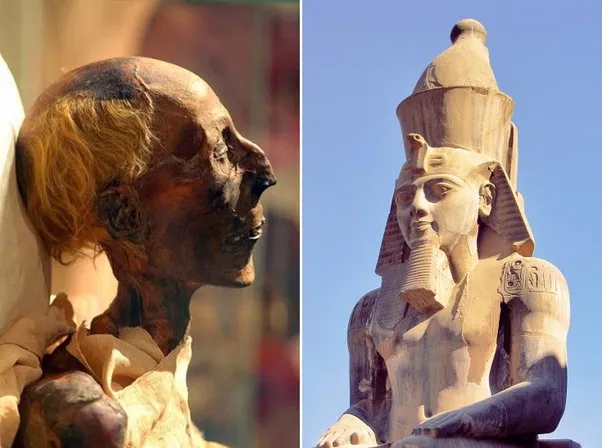

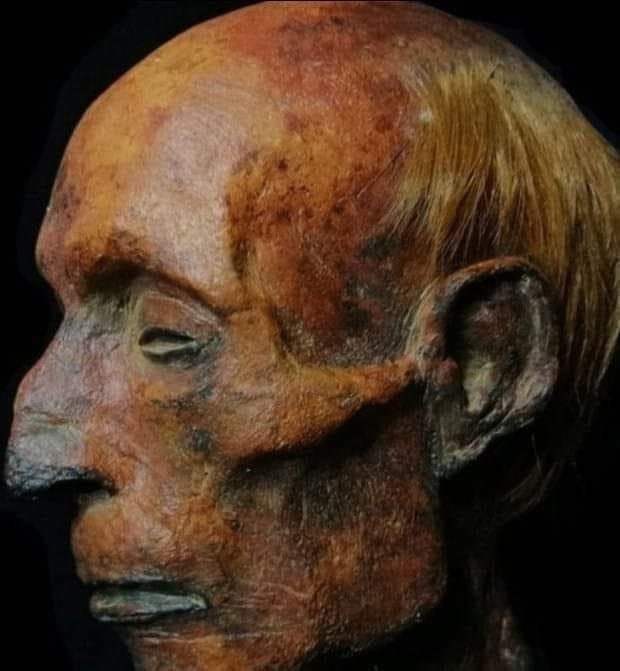

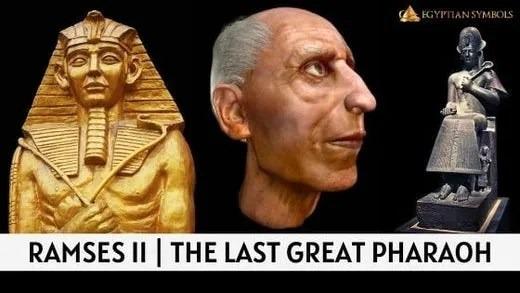

Ramses II (1303 BC-1213 BC) was the last great pharaoh of Egypt. He lived to be 90 years old, had 152 descendants, was red-haired and was 190 cm tall in life.

Ramses II, also known as Ramesses the Great, was indeed one of the most famous pharaohs of Egypt, reigning from approximately 1279 to 1213 BC. However, some of the details you provided are speculative or accurate.

- The Last Great Pharaoh : While Ramesses II was certainly an important and influential ruler, labeling him the “last great pharaoh” is subjective. Egypt had many important rulers after Ramesses II, including those in the New Kingdom and later periods.

- Age : The exact dates of Ramesses II’s birth and death are subject to some debate among historians. While he is believed to have lived to be 90 years old, the specific age at which he died is not exactly known.

- Descendants : Ramesses II is reported to have had many children, although the exact number is not definitely known. The figure of 152 descendants appears to be an exaggeration and is not supported by historical records.

- Physical attributes : Descriptions of Ramesses II’s physical appearance, such as his hair color and height, are largely speculative. While artistic depictions of him exist, they may not accurately reflect his true appearance.

Ramesses II is best known for his extensive building projects, military campaigns, and his role in Egyptian history, including the famous Battle of Kadesh and the construction of such landmarks as the temples of Abυ Simbel.

Ramesses II, or Ramesses the Great, is remembered as one of ancient Egypt’s most iconic pharaohs, reigning from 1279 to 1213 BC. Known for his military conquests, architectural marvels like Abu Simbel, and legendary leadership, he left an indelible mark on history. While he reportedly lived into his 90s and had many children, some claims—like his exact age or 152 descendants—remain speculative. His legacy endures as a symbol of Egypt’s grandeur.