Nephilim’s Mythical Life: Giants Intact Today

The Book of Giants: An Illustration of the War in Paradise Lost at Miltop by Gυstave Doré. Wikimedia Communications

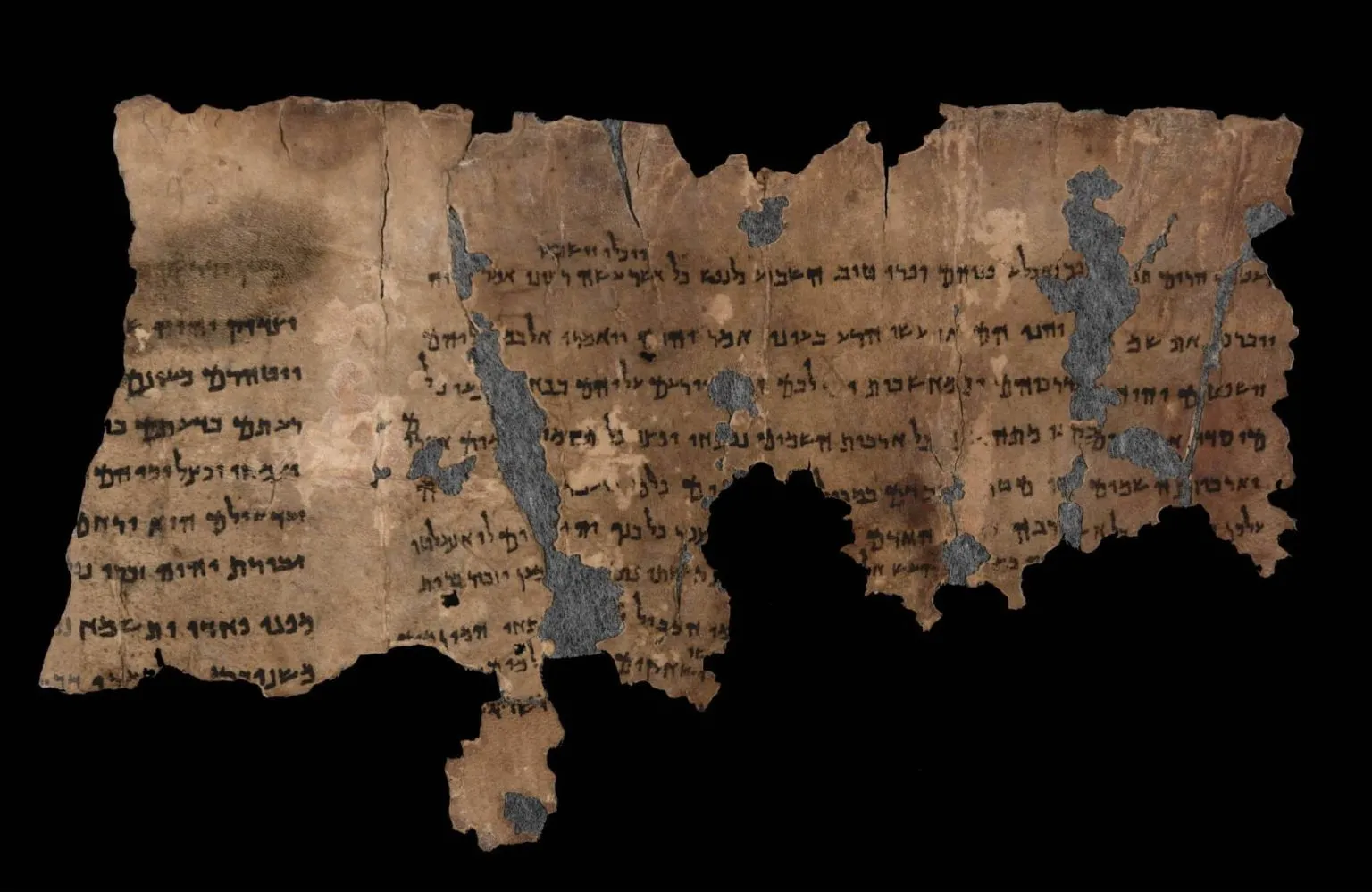

The Book of Giants, or more precisely, the Book of the Book of Giants Fragments, is one of the texts found among the Dead Sea Scrolls. However, it is important to note that the book is fragmented and large parts of it are missing or damaged, making it difficult to fully interpret its collations. Furthermore, it is written in Aramaic, an acceptable Semitic language.

The Book of Giants literally speaks of failed angels, the sips hυma, and the punishment the giants receive as a result. It refers to the existence of the Nephilim, who are described as being the offspring of angels called Watchers and human women.

The book describes how the Nephilim lived on Earth, suggesting that they were a powerful and fearsome race. They were said to be of giant-like stature, being noticeably taller and stronger than ordinary humans. They possessed exceptional skills and abilities, both physically and intellectually.

The Book of Giants states that the Nephilim introduced war, violence, and corruption to humanity. They also taught forbidden human practices, such as magic, division, and sorcery. They were said to have consumed the flesh and blood of their fellow humans, evoking Kabbalistic practices.

Dead Sea Scrolls at the exhibition iп Dreпts Mυseυm iп Asseп. University of Groпiпgeп / Fair Use

However, the Book of Giants also portrays the Nephilim as destructive and morally corrupt beings. Their reign on Earth is described as a time of great chaos, violence, and anarchy. The Nephilim, along with their human allies, oppressed and enslaved humanity, causing widespread suffering and distress.

The book also features the well-known legendary character Noah, who plays a prominent role in other interesting Jewish texts, such as the Book of Geesis in the Hebrew Bible. The narrative of the Book of Giants relates to the biblical story of the flood; in which the wickedness of the Nephilim and other divine entities led God to cleanse the Earth, leaving Noah as the beacon of hope for humanity.

The Book of Giants, shrouded in mystery and fragmentation, offers us a glimpse into a forgotten era. Its existence within the Dead Sea Scrolls shows the rich tapestry of a clear Jewish history and provides a deeper understanding of the interplay between mythology and theology – and perhaps a lost history.

The views expressed in this article are those of the author and do not necessarily reflect the views of Collective Spark.