Shocking Discovery: 9.7 Million-Year-Old Prehistoric Tooth Fossils Could Completely Rewrite Human History!

Shocking discovery: 9.7 million-year-old prehistoric tooth fossils could completely rewrite human history!

Last September, in southwestern Germany, a team of researchers discovered teeth millions of years old that presumably belonged to an ancient Eurasian primate. However, after the discovery became public, a controversy arose over the interpretation of our earliest existence.

News of the sensational discovery only recently became public, as the team that unearthed the ancient teeth in the town of Eppelsheim wanted to be sure the find was as significant as they had initially believed.

“It’s something completely new for science and it’s a big surprise because nobody expected such an extraordinary and extremely rare discovery,” Herbert Lutz, head of the excavation team at the Natural History Museum in Mainz, told Deutsche Welle.

Lutz had been excavating at the Eppelsheim site, where the Rhine once flowed, for 17 years, extracting sediments from the river bed that are about 10 million years old. The area is “well known in science” and famous for its primate fossils.

In late 2016, when his team decided to call it quits, “just at the last second, these two teeth came to light. We really didn’t expect such a tremendous discovery,” Lutz said.

The excavation site in Eppelsheim.

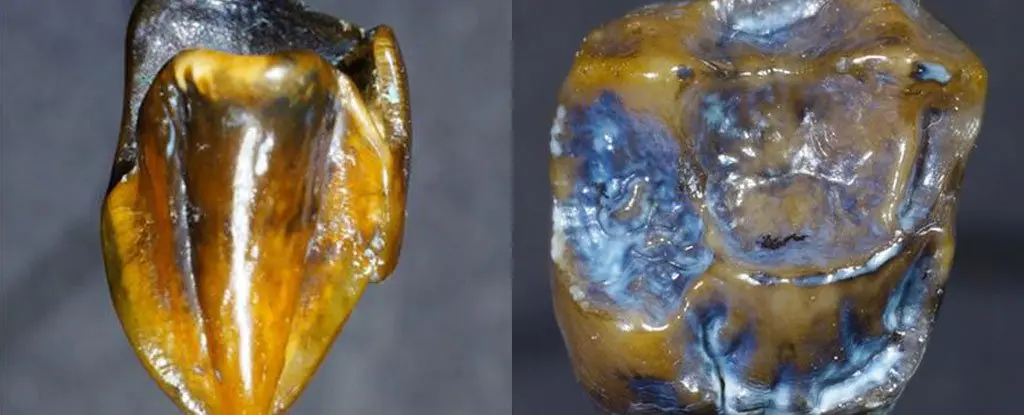

Both teeth are also fully preserved. The teeth look “excellent” and “shine like amber,” although they are no longer white, Lutz said.

The 9.7-million-year-old canine and upper molar (discovered just 60 centimeters apart and therefore considered to belong to the same group) resemble those of great apes that lived in Africa between 2.9 and 4.4 million years ago. According to Lutz and his colleagues, the teeth closely resemble some extinct African relatives of humans.

Fossils of molars (left) and canines (right) found in Germany raise questions about human history. Credit: Naturhistorisches Museum Mainz

Since the teeth were officially unveiled, international media have been questioning whether the find is capable of rewriting human history, as it appears to go against theories that hold that humans originated in Africa.

The teeth are unlike any found in Europe or Asia, Lutz says cautiously.

“It’s a complete mystery where this individual came from and why no one had ever found a tooth like this anywhere before,” he said in an interview with Research Gate.

But some experts say the teeth hardly “force us to reexamine the theory that humans originated in Africa,” arguing that the fossils “probably belonged to a very distant branch on the primate family tree,” National Geographic reported.

Other experts argue that it is questionable whether the teeth actually belong in the hominid classification (apes, chimpanzees, etc.).

Bence Viola, an expert on teeth from extinct human relatives and a paleoanthropologist at the University of Toronto, says the tooth found contradicts any hypothesis of a human connection.

“I think this is much ado about nothing,” he told National Geographic. “The molar, which they say clearly came from the same individual, is not at all hominid, and I would say not hominoid either.”

Most experts National Geographic spoke to said the tooth likely belongs to a species from a primitive, extinct branch of primates that lived in Asia and Europe between seven and 17 million years ago.