Shocking: Prehistoric Elephant Platybelodon’s “Shovel-Shaped” Jaw Discovered, Surprising Archaeologists

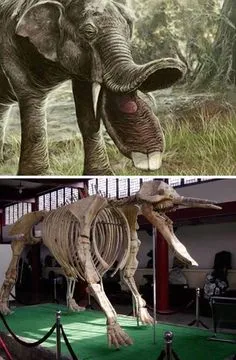

In the ancient world, where giants once roamed, Platybelodon was a creature that stood out for its unique and peculiar appearance. This extinct species of elephantine mammal lived about 15-4 million years ago during the Miocene Epoch and was part of the group known as Gomphotheres. What made Platybelodon particularly fascinating was its distinctive jaw structure, which resembled a large, flat spoon, or even a shovel, earning it the nickname “shovel-tusked elephant.”

A jaw like no other

The most notable feature of Platybelodon was its lower jaw, which was unlike anything seen in modern animals. The jaw was elongated and wide, with a pair of flattened tusks that extended outward like the blades of a shovel. This unique adaptation allowed Platybelodon to use its jaw in a variety of ways that were crucial to its survival.

The spoon-shaped jaw: a tool for survival

The Platybelodon’s jaw wasn’t just for show—it was a multi-functional tool. Paleontologists believe the animal used its jaw to gather vegetation, much like a modern backhoe. The flat, shovel-like tusks were likely used to remove bark from trees, dig up roots, and cut through tough plant material. This adaptation made Platybelodon an efficient forager, able to feed on a wide variety of vegetation.

In addition to its feeding function, the jaw may also have served as a means of defense. Platybelodon may have used its powerful tusks to fend off predators or compete with rivals during mating season. The jaw’s dual-purpose nature made it an essential part of Platybelodon’s daily life.

The life and extinction of Platybelodon

Platybelodon roamed the floodplains and forests of what is now Africa, Asia, and North America. It was a large herbivore, similar in size to modern elephants, but its unusual jaw set it apart from its contemporaries. Despite its impressive adaptations, Platybelodon eventually became extinct, likely due to changes in climate and vegetation that made it difficult for the species to survive.

A legacy in fossils

Today, Platybelodon is only known through the fossils it left behind. These fossils offer a glimpse into a world in which creatures like Platybelodon once thrived. The unique jaw structure of this ancient giant continues to fascinate scientists and laypeople alike, offering insight into the diverse and ever-changing nature of life on Earth.

Conclusion

Platybelodon was a remarkably adaptable creature, with a jaw that was both a tool for feeding and a weapon for defense. Though long extinct, the legacy of this spoon-jawed giant lives on in fossils that continue to captivate us and teach us about the rich history of life on our planet.