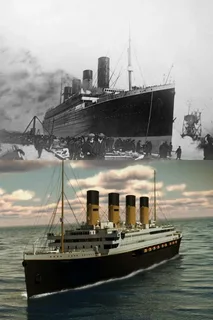

Titanic Passengers Return: Decades in the Deep

On April 14, 1912, the legendary ocean liner Titanic, on its maiden voyage, met its tragic fate after colliding with an iceberg, resulting in the loss of 1,500 lives. However, between 1990 and 1991, in the vicinity of the North Atlantic iceberg region, two individuals who had disappeared with the Titanic almost 80 years earlier were discovered and rescued.

The ship Foshogen was sailing in the North Atlantic Ocean on September 24, 1990, when Captain Karl suddenly saw a figure on the cliff.

Through binoculars, he clearly saw a woman calling for help. This woman was dressed in early 20th-century British aristocratic attire, was soaked and shivering from the cold.

When rescued from the ship, when questioned by the crew, she introduced herself as Wenni Kate, 29, a passenger on board the Titanic. She recounted how, when the ship sank, a huge wave swept her towards the iceberg and she was lucky enough to be rescued.

Her response left everyone extremely baffled, with many speculating that she was perhaps delirious due to fever. Kate was taken to a hospital for examination.

Apart from being excessively frightened by being lost at sea for several days, she showed no signs of physical or mental disorder. Blood and hair tests indicated she was around 30 years old.

Thus an incredible and perplexing question arose: could it be possible that from 1912 until now, almost 80 years later, Kate had not aged a day? Upon research and comparison with the Titanic’s passenger list, it was discovered that everything Kate said matched historical records. While people were still debating, the second incident occurred.

On August 9, 1991, during a scientific oceanographic survey in the southwest region, approximately 387 kilometers from the North Atlantic iceberg, a 60-year-old man was discovered and rescued.

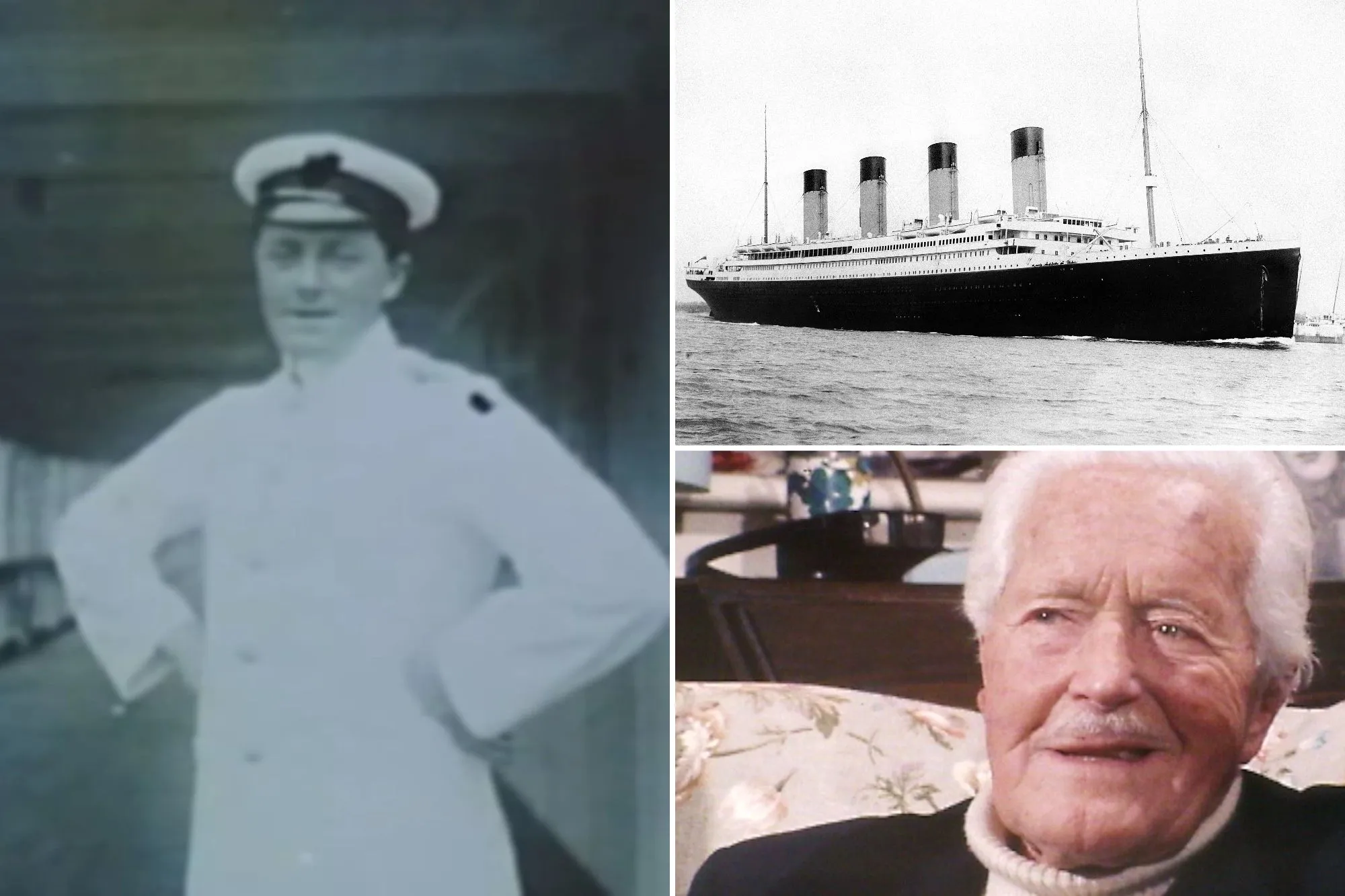

He was wearing immaculate white clothes and smoking a pipe. No one could believe that he was the renowned captain of the Titanic, Smith.

Renowned oceanographer Dr. Marwen Iderlan, after rescuing Smith, told the press that nothing could be more astonishing. This man could not be an impostor; in fact, he was the captain of the Titanic, the last person to go down with the ship.

Even more incredulous was the fact that Smith, at 140 years old, was actually only a 60-year-old man. When he was rescued, he vehemently insisted that it was September 15, 1912.

After being rescued, he was taken to the Oslo Psychiatric Institute (Norway) for treatment. Psychologist Jale Halant performed a series of tests and the results showed that Smith was perfectly normal. On 18 September 1991, in a brief statement, Halant confirmed that the rescued individual was indeed Captain Smith, as even a comparison of fingerprints indicated.

The incident requires a clear explanation. Some oceanographic agencies in Europe and America suggest that Captain Smith and passenger Kate had fallen into a “disappearance over time phenomenon”.