Pyramid Construction Unveiled: 5,000 Years Clarified

For thousands of years, the method behind the construction of the massive Egyptian pyramids has remained one of history’s greatest unsolved mysteries. But now, a groundbreaking discovery has stunned the world: international scientists have revealed that water was the key to how the ancient Egyptians moved the multi-ton stone blocks!

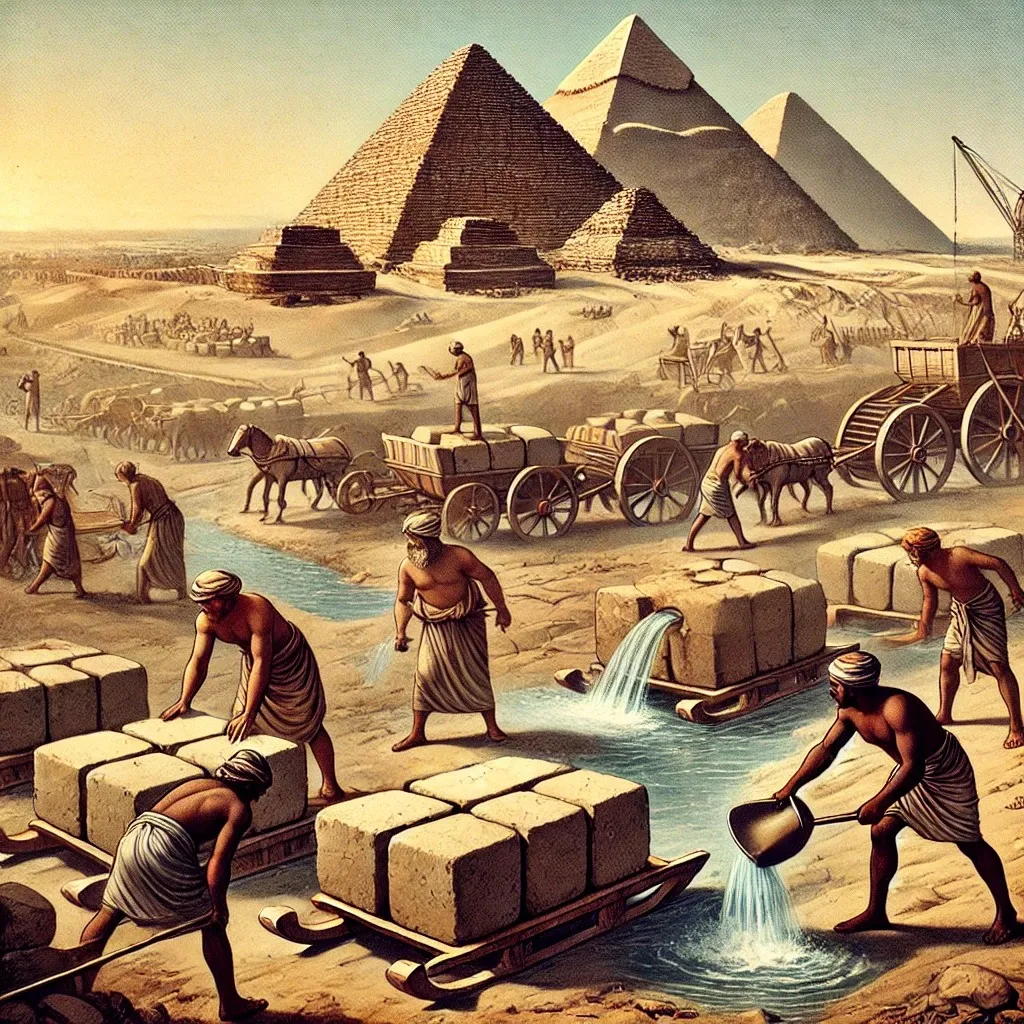

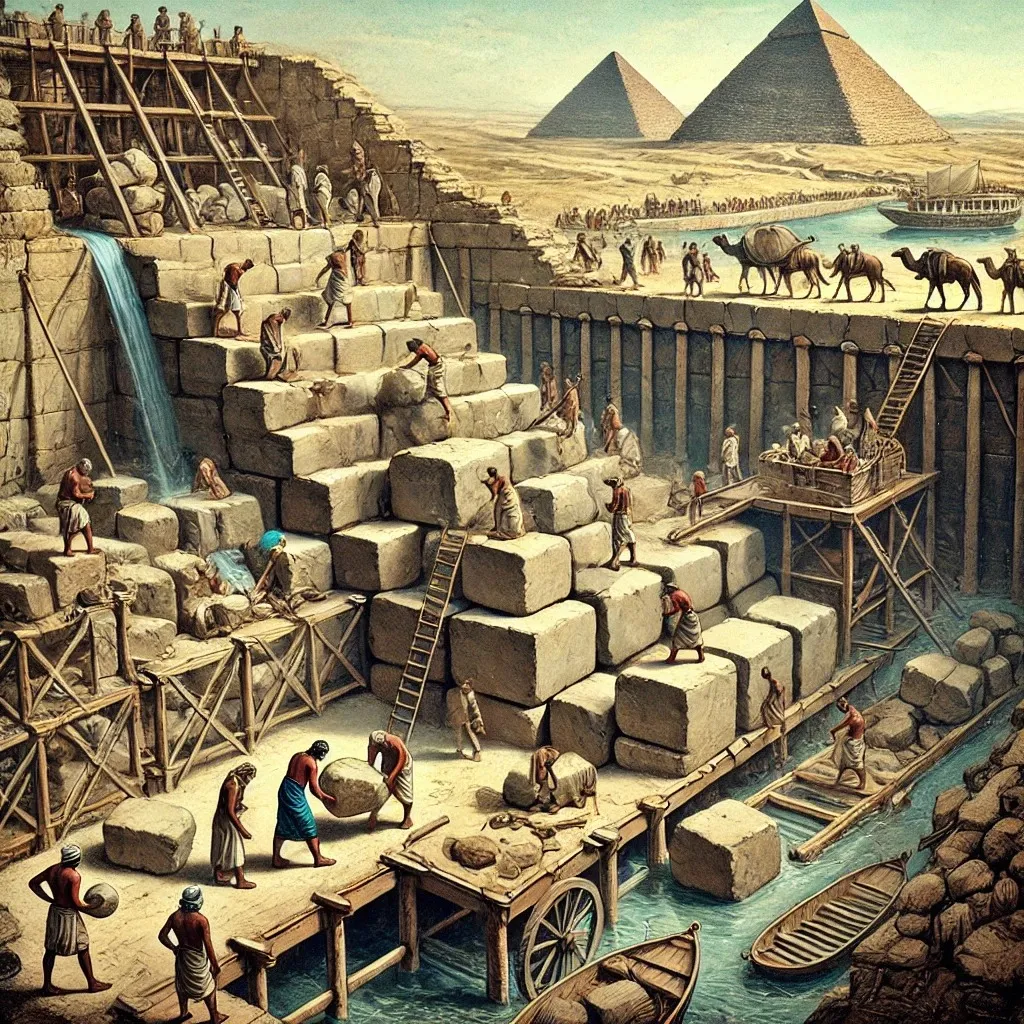

According to this new theory, the Egyptians used water to reduce friction when dragging the enormous stones across the desert. Ancient tomb paintings depict workers pouring water in front of sleds carrying the blocks. Far from being a ceremonial ritual, this was actually a brilliant technique to ease the effort. By wetting the sand, the grains stuck together, making it significantly easier to pull the sleds over the desert terrain.

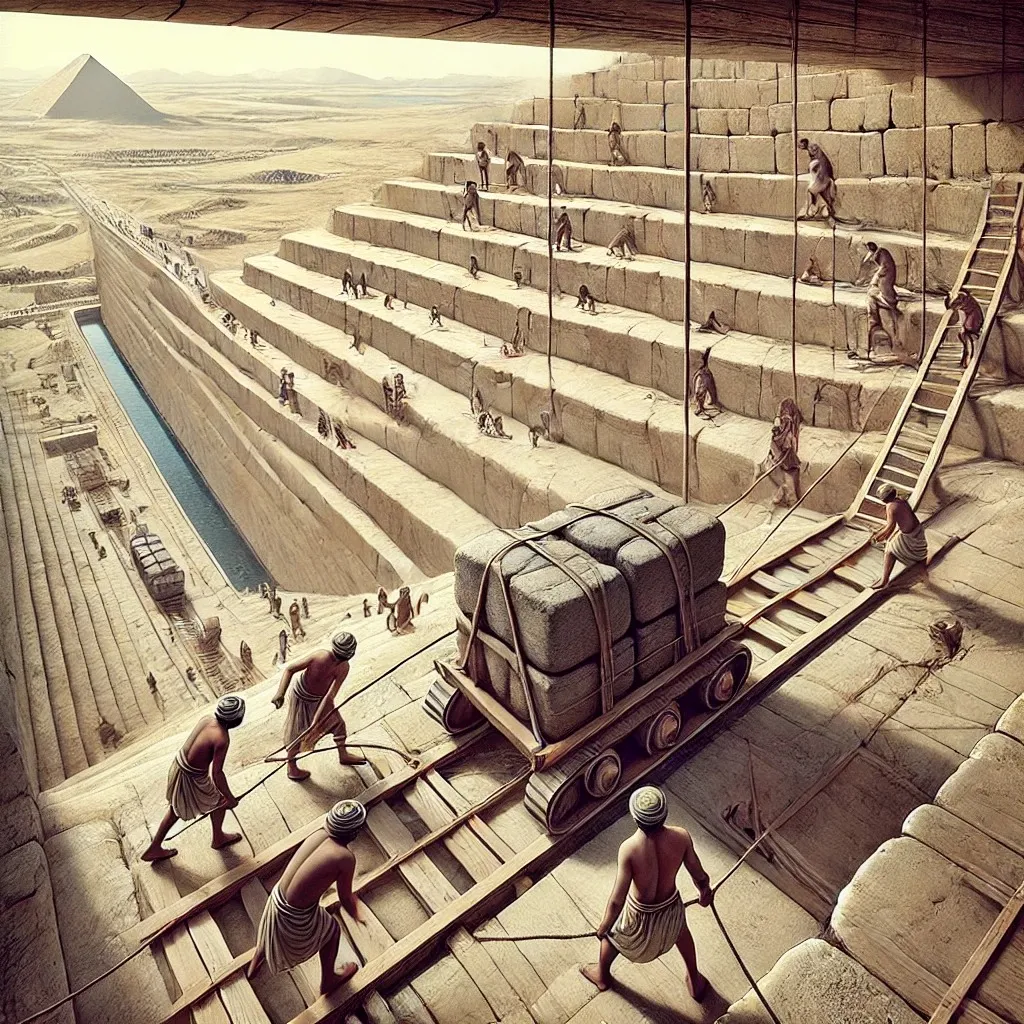

But that’s not all! Another theory suggests something equally shocking: the Egyptians may have built internal ramps inside the pyramids! Rather than using external ramps, these hidden passageways would have allowed workers to elevate the stones as the pyramid rose higher. While there is no direct evidence of such ramps on the outside, mysterious voids inside the pyramid walls could indicate their existence.

And the most surprising revelation: the Nile River played a crucial role in transporting the stones! Renowned Egyptologist Mark Lehner discovered an ancient port near the pyramids, suggesting that the Egyptians used an extensive network of canals to move the stones closer to the construction site. This theory is further supported by the discovery of an ancient papyrus diary from a worker named Merer, which detailed the logistics of transporting limestone blocks from Tura to Giza via waterways.

These stunning discoveries are completely changing how we understand one of the ancient world’s greatest wonders. After 5000 years, the truth is finally being uncovered, and it’s leaving us all astonished!