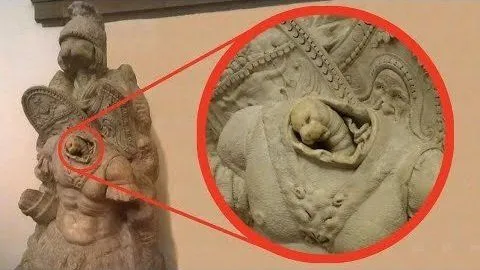

Warrior Statue’s Secret: A Creature Within?

In the field of archaeology, discoveries often lead to more questions than answers. Such is the case with the discovery of a mysterious creature hidden inside a warrior statue, leaving archaeologists baffled and intrigued by its presence.

The discovery took place during group excavations at a spectacular site, where archaeologists stumbled upon a statue depicting a fearsome warrior. However, upon closer look, they were shocked to discover that the statue contained a hidden compartment, within which lay a bewildering creature.

The creature’s family collaborated with archaeologists, who struggled to identify its species or determine its significance within the context of the statue. Its familiar features and effigy-like presence sparked a flurry of speculation and debate among experts, with theories ranging from symbolic representation to ritualistic significance.

Some archaeologists proposed that the creature may have served as a guard or protector, imbuing the warrior statue with mystical powers or spiritual significance. Others suggested that it could be a representation of a mythical creature from popular folklore, used to ward off evil spirits or invoke blessings for the statue’s owner.

Despite thorough analysis and examination, the creature’s true purpose and identity remain elusive, adding to the mystique surrounding the warrior’s status. Its presence within copies of the statue raises questions about the beliefs and practices of the culture that created it, offering a fascinating look into the mysteries of the past.

As archaeologists work together to unravel the secrets of the warrior statue and its epigmatic habitat, one thing remains certain: the discovery has added a new layer of complexity to our understanding of the civilizations that beckon. Whether the creature was placed within the state for symbolic, religious, or practical reasons, its presence serves as a reminder of the enduring allure and mystery of the archaeological record.