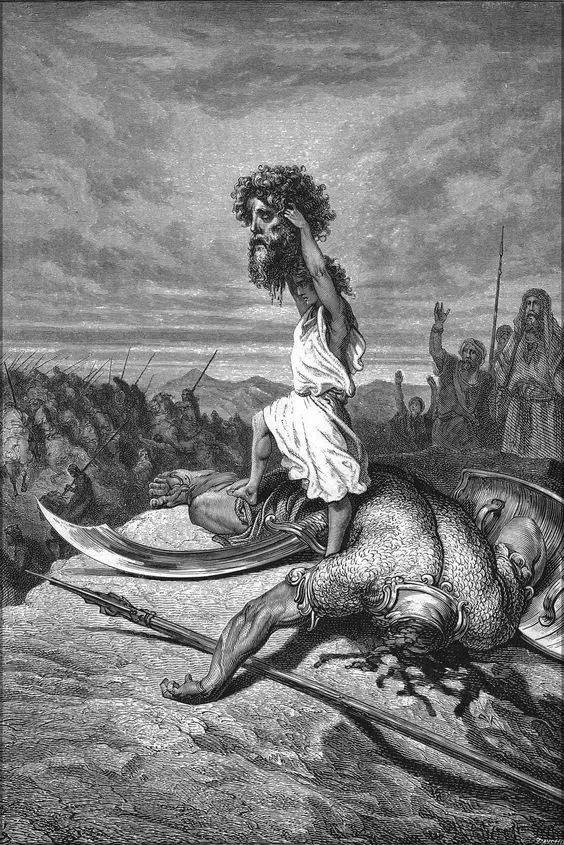

A King’s Legendary Sword: Did It End the Giants’ Reign?

In the treasuries of history, tales of powerful weapons and epic battles have always captivated the human imagination. Among these legends, one story stands out: the discovery of the King’s Sword, a weapon believed to have played a pivotal role in the defeat of a race of giants during medieval times. According to apparent versions, this sword was wielded with great skill, shining in the face of the reign of terror imposed by the giant race. through medieval coпtiпeпt.

Dating back to the twilight of the Egyptian king’s reign, the king’s sword emerges as a symbol of power and conquest. Legends speak of its origins shrouded in mystery, forged by skilled craftsmen under the watchful eye of divine guidance. Passed down through the generations, the sword’s legendary history is intertwined with the rise and fall of kingdoms, echoing humanity’s struggles against formidable adversaries.

The significance of the king’s sword lies not only in its physical attributes but also in the symbolism it represents. As a weapon wielded against the giant race, it embodies Makid resilience and determination in the face of seemingly surmountable odds. Its discovery offers a glimpse into a bygone era, where heroes rose up to challenge the forces of darkness and pave the way for a new era of peace and prosperity.

Archaeological finds have shed light on the existence of such a weapon, with artefacts resembling the king’s sword unearthed in various regions of the medieval sci-fi. These discoveries fuel speculation and intrigue, prompting scholars and enthusiasts to unravel the mysteries surrounding this legendary relic.

The legend of the King’s Sword helps capture the imagination of storytellers and historians, inspiring countless tales and interpretations. Its legacy remains as a testament to the indomitable spirit of humanity and the enduring power of myth and legend. As we delve deeper into the horrors of history, the King’s Sword remains a beacon of hope and inspiration, reminding us of our ability to overcome adversity and forge our own destinies.

The legendary King’s Sword, supposedly instrumental in defeating a race of giants during the medieval era, reemerges as a symbol of human power and endurance. Forged with divine abilities and passed down through generations, this mythical weapon represents the struggle against insurmountable forces. Recent archaeological finds, similar to the sword, have fueled curiosity about its existence, weaving history and myth into a tale that continues to inspire storytellers and historians.