The Eerie Attire of Maestro Titta: Rome’s Executioner and the Horrors He Wrought

A Life Steeped in Blood

Giovanni Battista Bugatti, known as Mastro Titta, was an Italian executioner of the Papal States who executed a staggering 514 people during his 68-year career spanning from 1796 to 1864. His legacy was one of fear and infamy, as he carried out sentences throughout the pontifical territory, earning him a notorious reputation

A Macabre Ritual

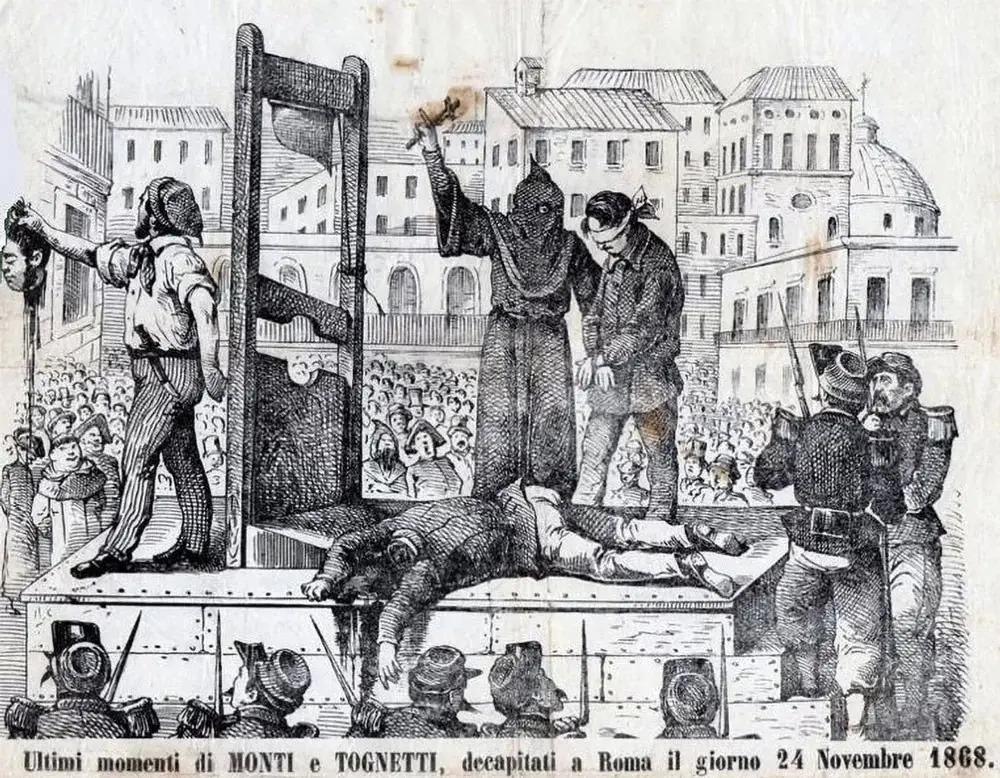

Executions were a morbid spectacle in Rome, drawing crowds of adults and children alike to witness the gruesome ritual. Piazza del Popolo, Campo de’ Fiori, and Piazza del Velabro served as stages for these public displays of capital punishment, with Mastro Titta crossing the Ponte Sant’Angelo to render his grisly services.

Eyewitness Accounts

Renowned writers such as Lord Byron and Charles Dickens bore witness to Mastro Titta’s handiwork, their accounts etching the horror of these executions into literary history. Byron’s vivid description of the “quick rattle and heavy fall of the axe” and the “splash of blood” captured the brutal reality, while Dickens’ encounter with Bugatti left an indelible mark on his travels through Italy.

A Macabre Legacy

Even after his retirement in 1864, Mastro Titta’s legacy lived on. His scarlet cloak, worn during executions, is preserved in the Criminology Museum of Rome, a grim reminder of the city’s darkest chapters. The very name “Mastro Titta” became synonymous with the executioner’s role, extending beyond Bugatti himself to his successors.

Through the eyes of poets, writers, and the people of Rome, Mastro Titta’s tale serves as a chilling testament to the brutal realities of capital punishment, a grim chapter in the city’s history that continues to haunt its streets and collective memory.

With 514 executions to his name, Giovanni Battista Bugatti, or Mastro Titta, became a symbol of justice and fear in 18th-century Rome. Public executions turned city squares into macabre theaters, drawing crowds and leaving marks on witnesses like Dickens and Byron. His story remains etched in Rome’s shadowy past.