The exquisitely sculpted tombs: An investigation into the Two Lovers of Teruel

These magnificently sculpted tombs represent Spain’s legendary version of “Romeo and Juliet.”

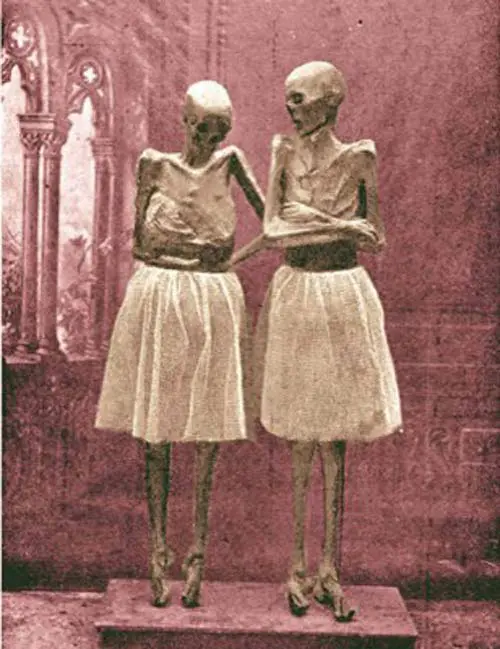

THIS PAIR OF TOMBS WAS created after two mummified bodies were discovered in the 16th century. The mummies were believed to belong to the legendary “Lovers of Teruel”.

Dome of the Hermitage of the Lovers of Teruel (Church of Sap Pedro de Teruel).

The story goes that two childhood sweethearts from the early 13th century, Diego Martínez Marcilla and Isabel Segura, were prevented by Isabel’s father from marrying when they came of age. Isabel’s wealthy father did not prevent her from marrying into the Marcill family because Diego’s father had fallen on hard times.

Isabel was able to persuade her father to wait five years before marrying her off to someone else. During these years, Diego was to leave the city and make his fortune elsewhere. Isabel’s father agreed, and the five years passed without a word from Diego.

The mummies found in the Church of Sap Pedro in Teruel, vintage photographs.

When he was finally able to return to the city five years later, Diego was distraught to discover that Isabel’s father had forced her to marry the day before he arrived. Diego didn’t realize that he was open a day late, just as he hadn’t considered the day the agreement was made to be part of the five-year limit.

During that fight, when Diego went up to Isabel’s bedroom, she refused to kiss him out of loyalty to her new husband, who was sleeping next to her. Heartbroken, Diego fell at her feet and died. Isabel was so distraught that she died at Diego’s funeral.

The mummies found in the Church of Sap Pedro in Teruel, vintage photographs.

The people of Teruel who knew the story of the two childhood sweethearts insisted that they be buried together. The discovery of two mummies in the 16th century added further fuel to the legend.

The grave

Despite modern evidence that these two bodies could be the two lovers, people still visit the Orpato mausoleum that houses their supposed remains. The two tombs, designed by Juan de Ávalos, depict the couple approaching each other in death.