Thailand’s 17th-Century Giants: A Hunt Near Extinction

In the 17th century, the Thai kingdom witnessed an extraordinary and devastating phenomenon: a royal pride dominated by a fascination with giant creatures. The story of this great pride, led by the Thai king, is a gripping tale of obsession, power and the dangerous impact on wildlife.

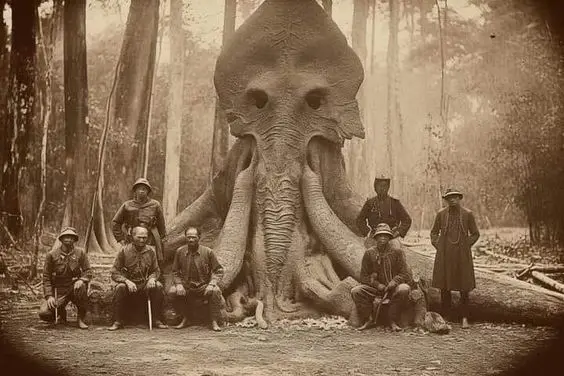

The story begins with the Thai king’s uncontrollable desire to capture and display huge animals. These giant creatures, which ranged from elephants to other large wild animals, symbolized power and prestige in the royal court. The king’s ambition was not simply sporting, but was deeply intertwined with his desire to demonstrate his dominance and the power of the kingdom.

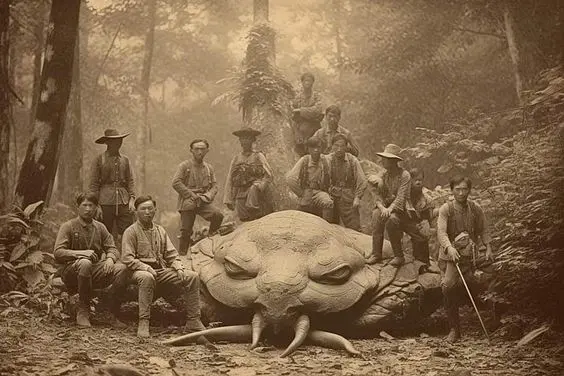

Royal lodges were significant events, meticulously placed and precisely executed. The king, accompanied by a group of nobles and skilled hunters, would embark on these expeditions, deep into the wilderness. The thrill of the chase and capture of these huge animals was celebrated with great ceremony, cementing the king’s status and captivating the court and commoners alike.

However, the relentless pursuit of these giant creatures came at a high cost. As the royal lodges expanded, the population of these majestic animals began to decline. The rapid extinction of some species was a direct consequence of the king’s insatiable demand. The ecological balance was severely upset, causing a domino effect on the environment and the rest of wildlife.

The impact of these habitats extended beyond the immediate loss of animal life. Forests, once teeming with diverse species, became degraded as habitat pressures increased. This environmental decline affected not only animals, but also the people who depended on forest resources for their livelihoods. The pursuit of giant creatures, while a symbol of royalty, precipitated a cascade of ecological and social repercussions.

In retrospect, the 17th-century orchards led by the Thai king serve as a reminder of the delicate balance between human ambition and maturity. The pursuit of giant creatures, though rooted in a desire for prestige, was undoubtedly the beginning of an era of imminent extinction for many species. This historical episode underscores the importance of sustainable practices and the need to harmonize human efforts with the preservation of our natural world.

In conclusion, the 17th-century Thai king’s hut for giant creatures is a compelling story of ambition and its intended consequences. It is a story that resonates with contemporary debates about conservation and the ethical treatment of wildlife. Reflecting on this period, it becomes clear that the lessons learned are crucial to guiding future interactions with our environment. The preservation of biodiversity and the careful management of natural resources remain of paramount importance in ensuring a balanced coexistence between humanity and Earth’s magnificent creatures.