Shroud of Turin’s Image: 800 Years of Quiet Debate

New scientific tests on the Shroud of Turin, which went on display Saturday in a special TV appearance introduced by the Pope, dates the cloth to ancient times, challenging earlier experiments dating it only to the Middle Ages.

Pope Francis sent a special video message to the televised event in the Cathedral of Saint John the Baptist in Turin, Italy, which coincided with Holy Saturday, when Catholics mark the period between Christ’s crucifixion on Good Friday and his resurrection on Easter Sunday.

The Vatican, tiptoeing carefully, has never claimed that the 14-foot linen cloth was, as some believers claim, used to cover Christ after he was taken from the cross 2,000 years ago.

Francis, reflecting that careful Vatican policy, on Saturday called the cloth, which is kept in a climate-controlled case, an “icon” — not a relic.

But Cesare Nosiglia, the Archbishop of Turin and “pontifical custodian of the shroud,” said the special display on Holy Saturday “means that it represents a very important testimony to the Passion and the resurrection of the Lord,” The Telegraphreported.

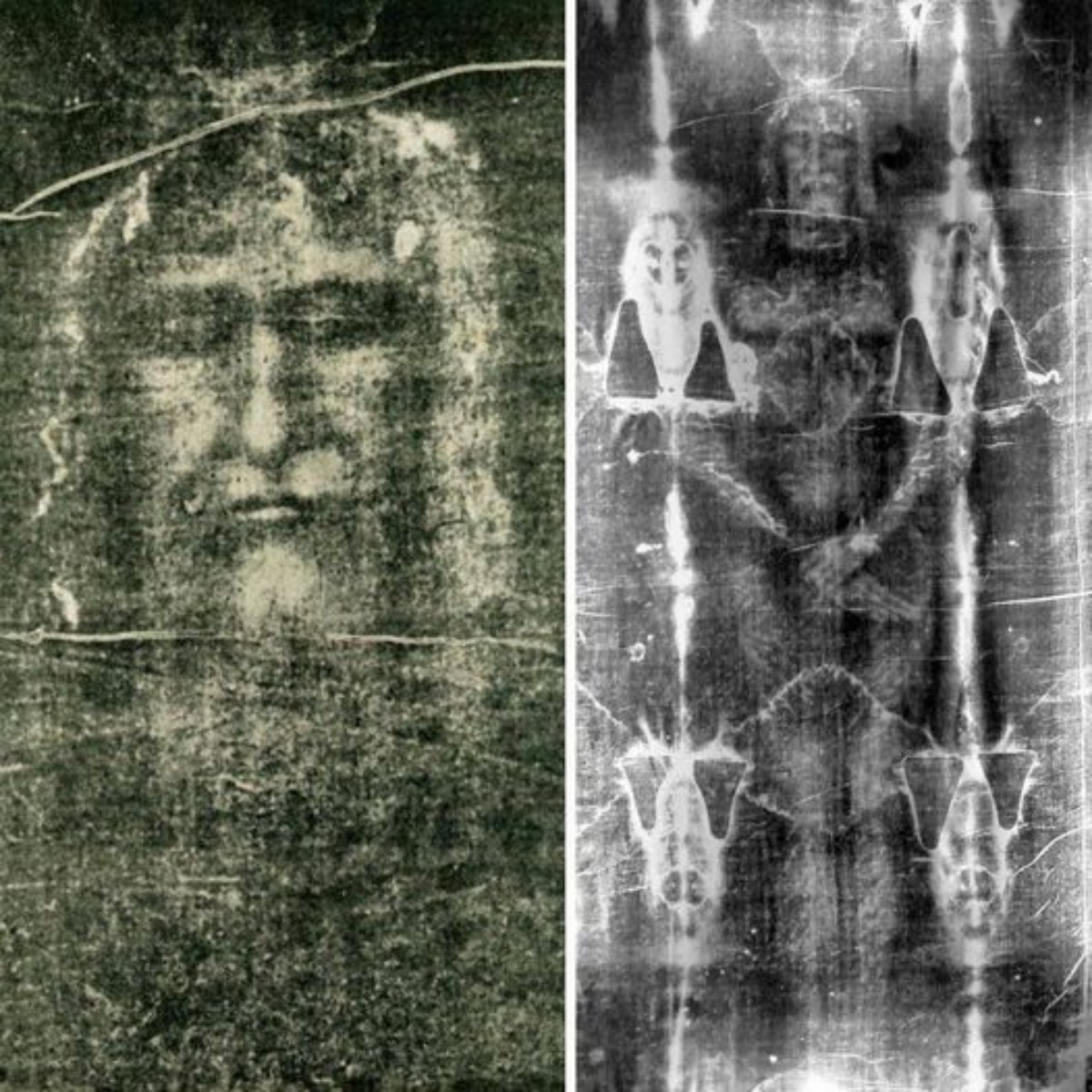

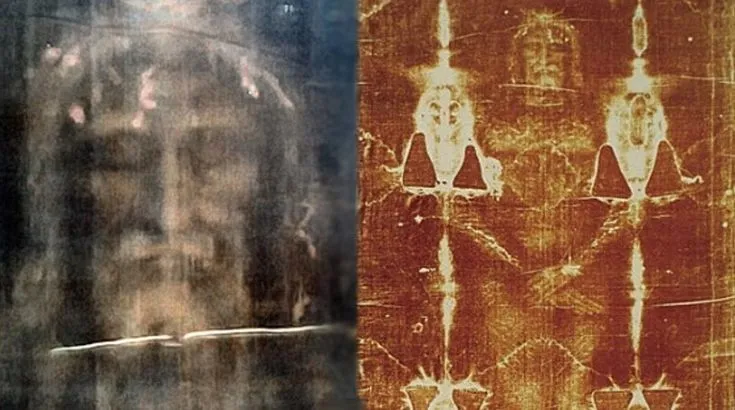

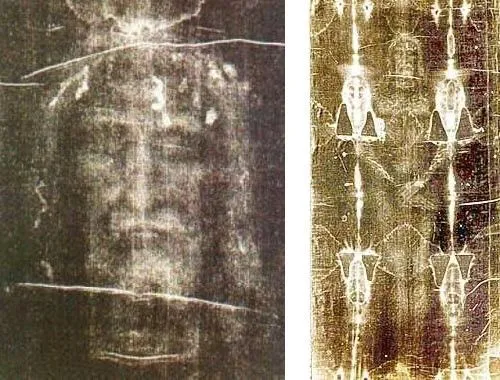

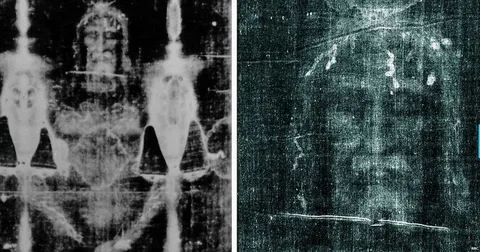

The burial shroud purports to show the imprint of the face and body of a bearded man. The image also purportedly shows nail wounds at the man’s wrist and pinpricks around his brow, consistent with the “crown of thorns” mockingly pressed onto Christ at the time of his crucifixion.

Many experts have stood by a 1988 carbon-14 dating of scraps of the cloth carried out by labs in Oxford, Zurich and Arizona that dated it from 1260 to 1390, which, of course, would rule out its used during the time of Christ.

The new test, by scientists at the University of Padua in northern Italy, used the same fibers from the 1988 tests but disputes the findings. The new examination dates the shroud to between 300 BC and 400 AD, which would put it in the era of Christ.

It determined that the earlier results may have been skewed by contamination from fibers used to repair the cloth when it was damaged by fire in the Middle Ages, the British newspaper reported. The cloth has been kept at the cathedral since 1578.

He also said his tests also supported earlier results claiming to have found traces of dust and pollen on that shroud that could only have come from the Holy Land.

The latest findings are contained in a new Italian-language book — Il Mistero Della Sindone or The Mystery of the Shroud, by Giulio Fanti, a professor of mechanical and thermal measurement at Padua University, and Saverio Gaeta, a journalist.

Fanti, a Catholic, used infra-red light and spectroscopy – the measurement of radiation intensity through wavelengths — in his test. He said the results are the outcome of 15 years of research.

The Telegraph also reports that a new app, sanctioned by the Catholic church and called “Shroud 2.0,” allows anyone to use a smart phone or tablet to explore the shroud in detail.