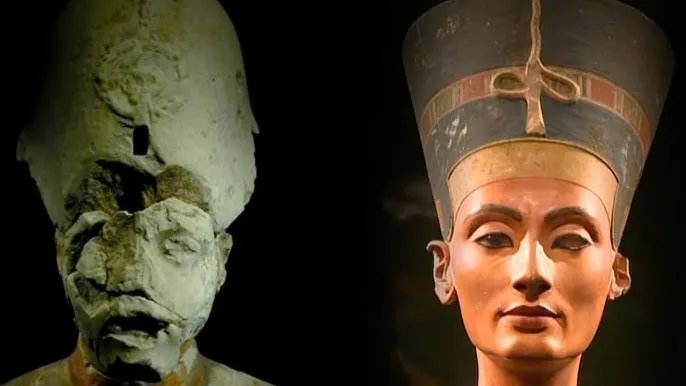

The world renowned bust of Egyptian Queen Nefertiti, believed to be 3,400 years old, is at the center of contentious debate on whether the famed artifact is genuine or just a forgery.

One of history's most famous archaeological finds may just be a fake, claims one art historian. The world renowned bust of Egyptian Queen Nefertiti, believed to be 3,400 years old, is at the center of contentious debate on whether the famed artifact is genuine or just a forgery.

Housed in a Berlin museum, the iconic bust is one of the most copied works of ancient Egypt but its legitimacy has been put into question by Swiss art historian, Henri Stierlin, who claims that the bust is just a copy dating from 1912.

Stierlin says an archaeologist at the time had hoped to produce a new portrait of the queen wearing a necklace he knew she had owned, and was also looking to carry out a color test with ancient pigments found at the digs.

"It seems increasingly improbable that the bust is an original," Stierlin told AFP.

Bust in Germany: “fake”

The startling claim stroked already tense relations between Egypt and Germany, the former having already made requests for the immediate return of the artifact since it went on display in 1923.

The colorful bust depicts a stunning woman – believed to be Nefertiti – wearing a unique cone-shaped headdress. Stierlin, author of a dozen works on Egypt, the Middle East and ancient Islam, says the bust currently in Berlin’s Altes Museum was made at the order of German archaeologist Ludwig Borchardt by an artist named Gerardt Marks.

On Dec. 6, 1912, the copy was admired as an original work by a German prince and Borchardt "couldn’t sum up the courage to ridicule" his guest, Stierlin said.

He claimed it was impossible to scientifically establish the date of the bust because it was made of stone covered in plaster. The historian, who has been working on the subject for 25 years, said he based his findings on several facts.

But Egyptian authorities are crying foul, claiming that the allegations regarding the legitimacy of one of Egypt’s most prized artifacts are unfounded.

"Stierlin is not a historian. He is delirious," Zahi Hawas, Secretary General of Egypt’s Supreme Council of Antiquities told AlArabiya.

Hawas, the leading expert on ancient Egypt, refuted a number of claims Stierlin cited in his argument over the age of the bust, including its design and original condition.

Stierlin said the shoulders were cut vertically in the style practiced since the 19th century while "Egyptians cut shoulders horizontally" and that the features were accentuated in a manner recalling that of Art Nouveau.

But Hawas argued that the era of Pharaoh Akhenaten and his wife Nefertiti was distinguished by a new type of art form that broke free from all traditional styles.

"Thus, the paintings and statues belonging to this period came out different," he said.

Stierlin noted that the bust has no left eye and this would have been an insult to the queen at the time, so it couldn’t have been carved during Nefertiti’s reign.

Hawas again refuted the claim saying that the bust had a left eye that was damaged.

"The royal sculptor Tohotmos made it with two eyes, but one was later destroyed."

Stierlin also listed problems he noted during the discovery and shipment to Germany as well as in scientific reports of the time.

French archaeologists present at the site never mentioned the finding and neither did written accounts of the digs. The earliest detailed scientific report appeared in 1923, 11 years after the discovery.

The archaeologist "didn’t even bother to supply a description, which is amazing for an exceptional work found intact," Stierlin said.

Hawas agreed with him regarding the report, but attributed it to the fact that the French archaeologists in charge of Egypt’s antiquities at the time were not present in Tel al-Amarna where the bust was discovered.

It seems increasingly improbable that the bust is an original

Henri Stierlin, Swiss archaeologist

Nefertiti smuggled to Germany

Stierlin’s new "findings" come shortly after a document from 1924 was found charging archaeologist Ludwig Borchardt with "cheating" to secure the bust for Germany. Zahi Hawas has called on Berlin to return the bust of Nefertiti and has led a global campaign to recover all plundered artifacts scattered across the globe.

The smuggling of Nefertiti’s bust has become something of a legend in archaeological circles. After discovering it, Ludwig Borchardt took it to his house in Cairo and hid it amidst pieces of broken pottery going to Berlin for restoration. Since then, the bust has been displayed in Germany.

Stierlin added that Borchardt never provided a detailed description of the artwork that was supposed to be of extreme significance and value.

Borchardt "knew it was a fake," Stierlin claimed. "He left the piece for 10 years in his sponsor’s sitting-room. It’s as if he’d left Tutankhamen’s mask in his own sitting-room."

Hawas disagrees claiming that, "Borchardt made a detailed report about the bust and it was amazing how accurate his description was."

However, Hawas broke the news that the most famous story of antiquity smuggling in Egypt is, in fact, untrue.