India’s Giant Visitors: 6,000-Year-Old Clues

Revealing ancient encounters: Evidence suggests giant creatures visited India 6,000 years ago

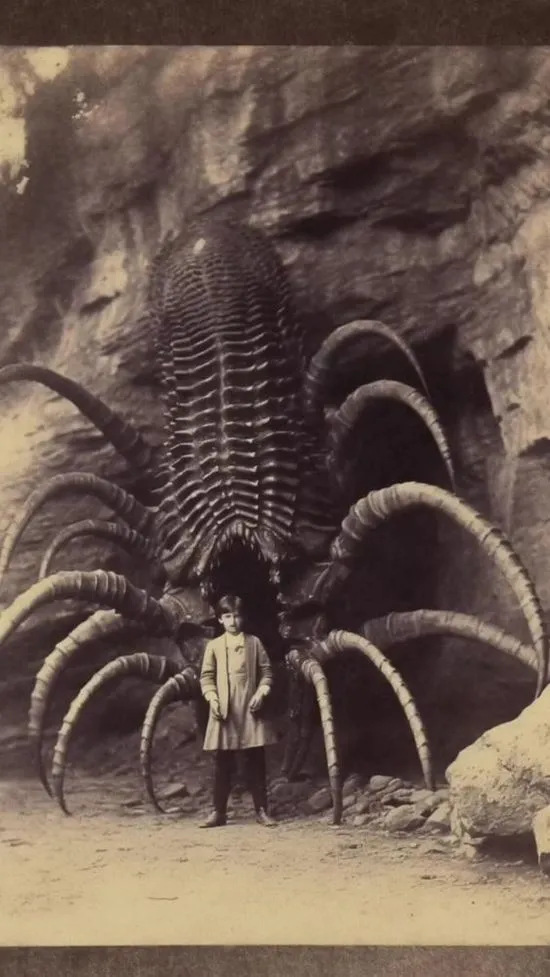

Ancient Indian texts and legends have long fascinated historians and researchers with their vivid descriptions of incredible phenomena. Among the most intriguing are accounts of giant creatures and advanced flying machines dating back more than 6,000 years, suggesting possible extraterrestrial encounters in ancient India.

Ancient texts and giant creatures

Historical records, such as the Indian epics Mahabharata and Ramayana, often mention beings of extraordinary size and power. These texts describe “Asuras” (demons) and other giants engaging in epic battles with gods and humans. Some interpretations suggest that these creatures may have been real visitors from another world, who came to India during a time of great upheaval and technological wonders.

The Vimanas: Ancient Flying Machines

Central to these ancient accounts are the Vimanas, described in texts such as the Vaimānika Shāstra and the Samarangana Sutradhara. These flying machines were said to be capable of interplanetary travel, powered by advanced propulsion systems possibly utilizing mercury vortex engines or anti-gravity technology. Descriptions of Vimanas highlight their ability to ascend, descend, and maneuver through the skies with ease, hinting at technologies far beyond the capabilities of ancient civilizations.

Dr AV Krishna Murty, professor of aeronautics, and Dr Raghavan, a noted scholar, studied these texts and concluded that ancient India possessed knowledge of sophisticated aeronautics, potentially influenced by extraterrestrial visitors.

Extraterrestrial influence and technology

The idea that ancient civilizations were visited by extraterrestrial beings is supported by discoveries such as ancient Sanskrit documents found in Tibet. These documents, when translated, revealed blueprints for interstellar spacecraft. The propulsion systems described in these texts involve anti-gravitational technology based on “laghima,” a mysterious force mentioned in Hindu yogic practices that supposedly enables levitation.

Furthermore, researchers propose that ancient monuments, such as pyramids and megalithic structures, could have served as energy transmitters for these advanced flying machines. The strategic placement of these monuments over magnetic vortices or ley lines could have allowed them to tap into the Earth’s natural energy, suggesting a global energy transmission network.

Conclusion

While mainstream science often views these accounts with skepticism, persistent references in ancient texts and recent archaeological discoveries suggest that the history of human civilization might be more complex than previously thought. Tales of giant creatures and Vimanas in ancient India provide fascinating insight into a possible era of advanced technology and extraterrestrial interactions, inviting further exploration and study of our planet’s ancient past.