America’s Unearthed Giants: A World Below Us

In a shocking revelation, recently uncovered photographs and historical accounts suggest a connection between the ancient mound builders of North America and legends of towering giants who once roamed the continent. These giants, according to folklore and unverified reports, were not only physically immense but also instrumental in the construction of ancient earthworks and mounds scattered across the United States.

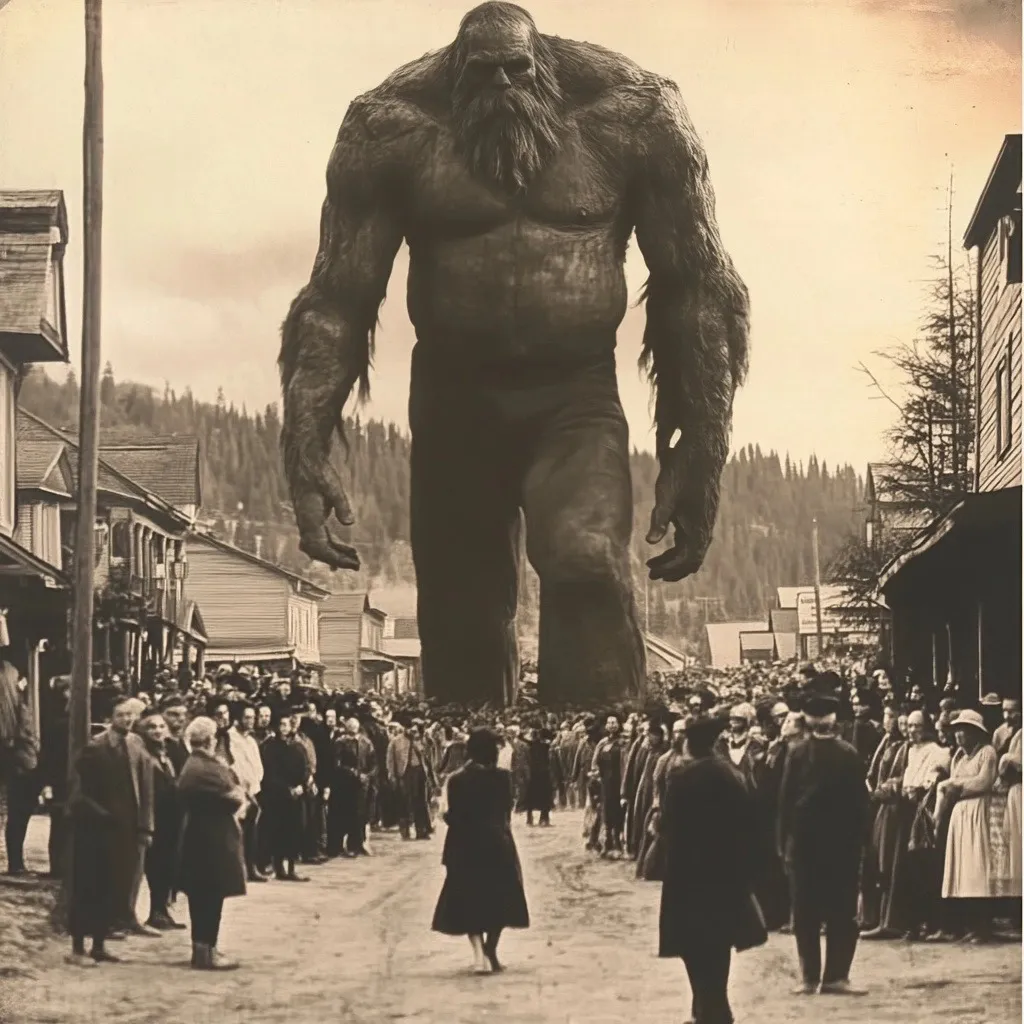

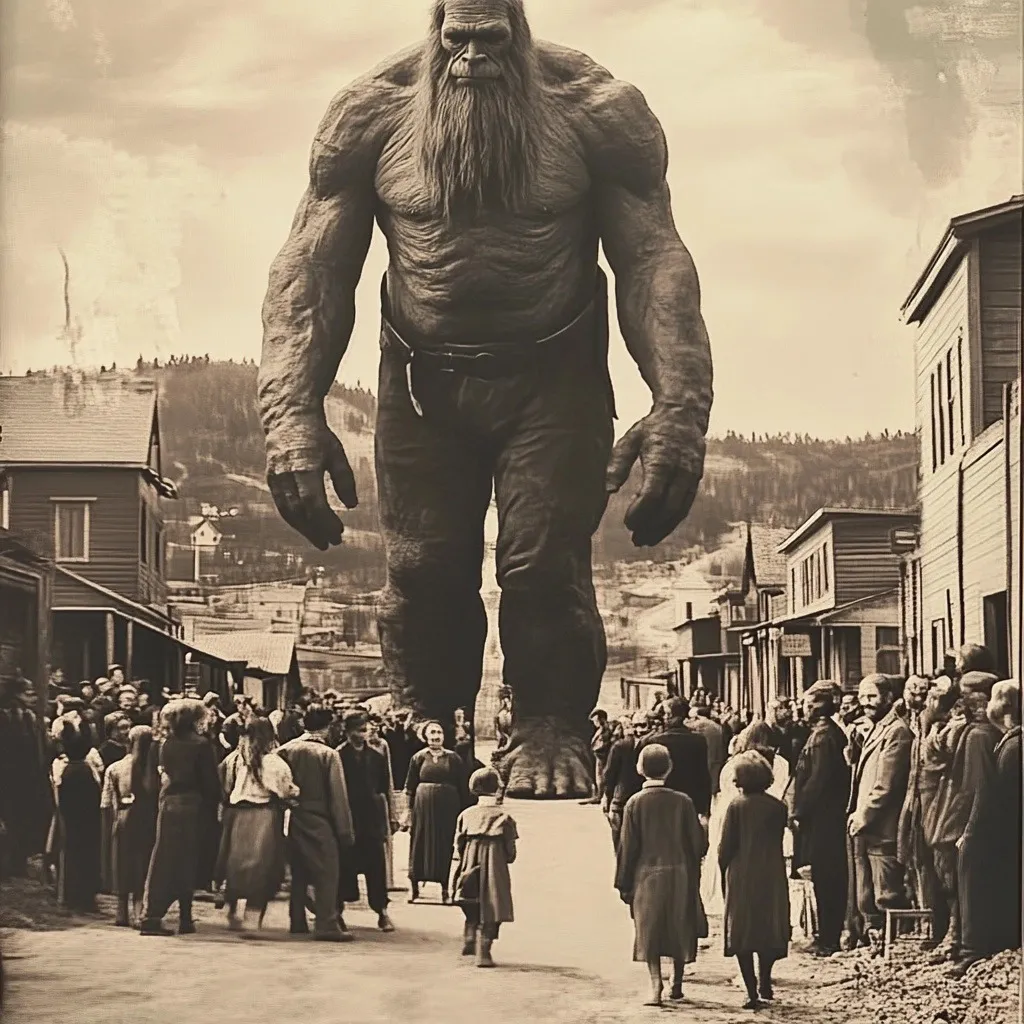

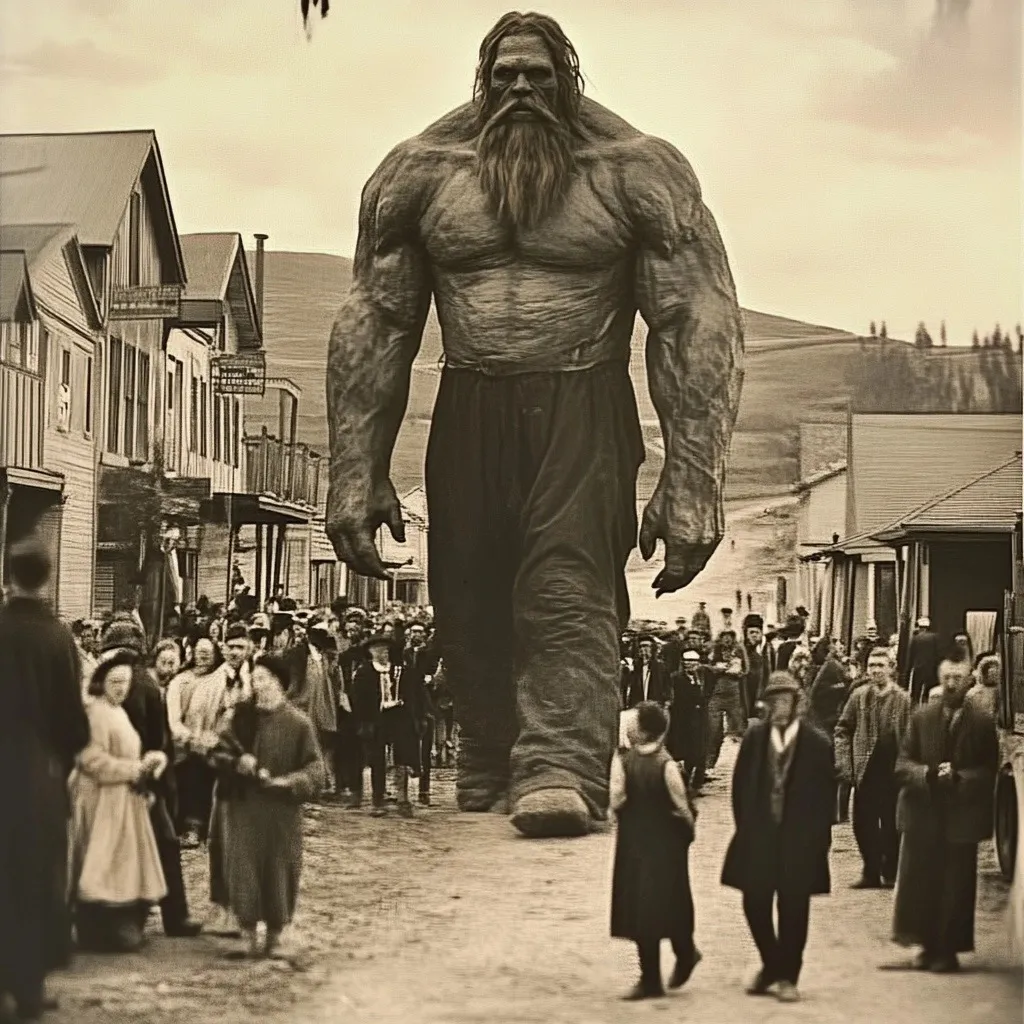

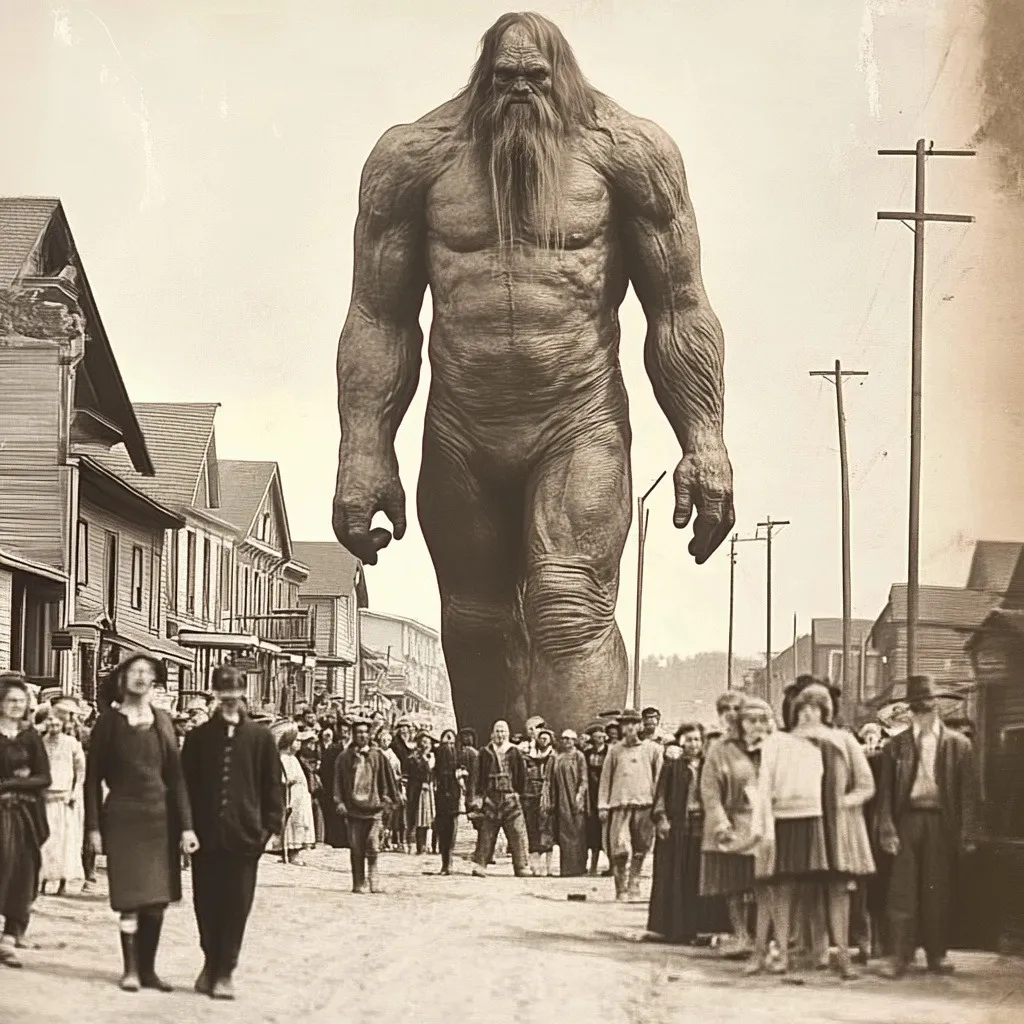

Theories about giants and “Hollow Earth” have intrigued explorers and researchers for centuries, and these latest findings appear to offer compelling visual evidence. The images depict extraordinarily tall individuals standing among people of average height, dwarfing them by comparison. These purported giants are often shown walking among humans with an air of reverence or mystery, hinting at a forgotten chapter of human history.

The story of the mound builders, a prehistoric culture known for their massive earthen structures, has long been shrouded in mystery. While mainstream archaeology attributes these mounds to indigenous civilizations who built them for ceremonial and burial purposes, some alternative historians argue that the scale and complexity of these mounds could hint at the involvement of beings with exceptional strength and stature—possibly giants. Could these giants have had a role in shaping the ancient landscape of North America?

Supporters of the Hollow Earth theory suggest that an advanced civilization of giants might have originated from deep within the Earth, emerging periodically to interact with surface dwellers. Legends from various Native American tribes speak of encounters with towering beings who inhabited the land before the arrival of modern humans. Could these legends be more than just myths? Could they be glimpses into a lost world beneath our feet?

Critics argue that these claims lack scientific backing, and that photographs and stories about giants are either fabrications or misinterpretations of historical records. However, the fascination with giants and the possibility of Hollow Earth remains strong, with advocates continuing to search for proof in ancient texts, artifacts, and, now, visual documentation.

This discovery reignites questions about humanity’s forgotten history and challenges our understanding of Earth’s past. Whether these findings are genuine evidence of giants or merely artifacts of human imagination, they open a window into a world of myth and mystery that has yet to be fully explored. The story of the mound builders and giants might be waiting, hidden beneath layers of history, for those willing to seek the truth.