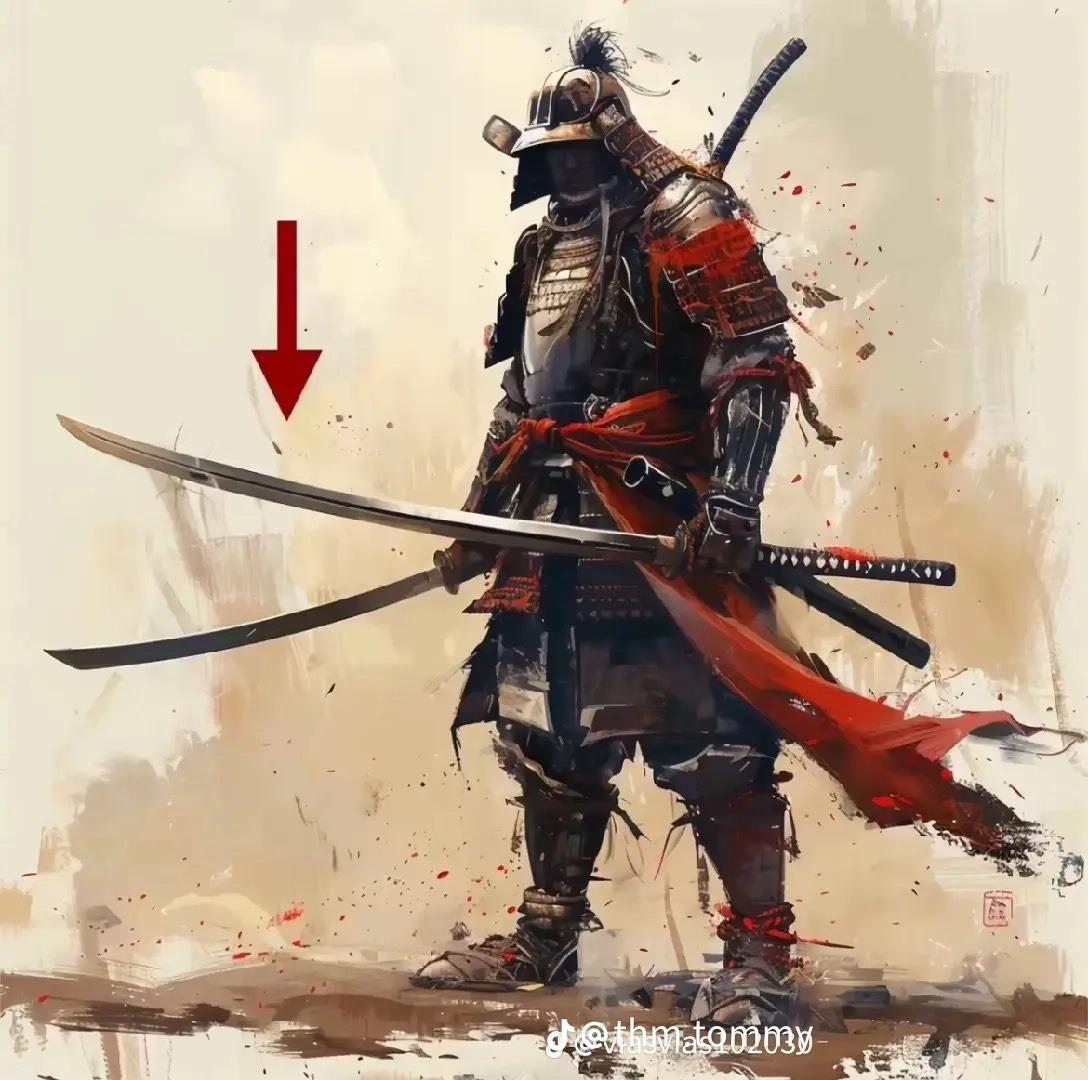

Thousand-Year-Old Samurai: A Giant Rises Again

The excavation took place when construction workers discovered a giant metal object in the ground. Archaeology experts were immediately called in and excavation work began. The first images from the scene show a giant helmet with intricate details, which appears to belong to a samurai warrior.

As the excavations continued, archaeologists found a giant, extremely elaborate metal arm. This arm is much larger than any relic previously discovered.

Finally, the entire body of the giant samurai is revealed, complete with armor and very well-preserved details. This is truly an unprecedented discovery, suggesting many theories about the technology and techniques of the ancients.

This discovery has raised many questions about the technical skills of the ancient Japanese. How were they able to make and operate such giant metal objects? Is this an ancient robot used in war or simply a work of art?

Researchers are conducting a detailed analysis of the materials and manufacturing techniques of the excavated metal pieces. At the same time, they will also conduct geological studies to learn more about the historical and cultural context of this area.

The discovery of this giant samurai is not only an important milestone in archaeological research, but also opens up new directions of research into the technological and cultural history of ancient Japan. Researchers hope to have more new discoveries in the near future, which will help us better understand the glorious past of this nation.

Images and information from the excavation will continue to be updated. This is truly a groundbreaking discovery that promises to change many of our perceptions about world history and culture.

Construction workers unearthed a giant metal artifact, sparking an extraordinary discovery: a colossal samurai figure, complete with intricate armor and a massive metal arm. This unprecedented find raises questions about ancient Japanese technology—was it an ancient war robot or an artistic marvel? Archaeologists are delving into its materials and context, aiming to uncover secrets that could revolutionize our understanding of Japan’s historical and technological legacy.